Finding the silver lining

OPTIMISM FOR GRAIN FARMERS IN A VOLATILE GLOBAL ECONOMY

grain farmers should look to 2012 with optimism. Despite the economic volatility that is expected to continue into the new year buoyed by Europe’s financial crisis, indications are strong that crop growers will benefit from a marketplace with limited supply at a time when worldwide demand for commodities is rising.

Demand for commodities will continue to be largely driven by growth in emerging markets, says Jean-Philippe Gervais, senior agriculture economist with Farm Credit Canada. He points to countries such as China, India and smaller Asian nations of Vietnam and Indonesia where real Gross Domestic Product growth is expected to approach double-digit figures, according to International Monetary Fund projections.

How much growth will be realized from these emerging markets will depend on the influences of the European economic situation and the US recovery rate, which has been progressing slower than anticipated, says Gervais. Setbacks with either one could mean reduced growth prospects.

The challenge will be getting Canadian crops into these emerging markets. “The fastest growing regions, such as South Asia, are least open to agri-food trade,” he says (see Figure 1). In contrast, North America is the most open region in the world to agri-food trade, even with the tariffs in place to protect the supply managed sectors, yet North America has some of the lowest growth potential.

FIGURE 1. WORLD AGRICULTURAL TARIFF AVERAGES, BY REGION. SOURCE: UNITED STATES DEPARTMENT OF AGRICULTURE – ECONOMIC RESEARCH SERVICE.

FIGURE 2: REAL GDP GROWTH (2016)

THE MAP CLEARLY ILLUSTRATES THE DIVIDE BETWEEN THE WESTERN WORLD AND EMERGING COUNTRIES. GROWTH IS HIGHER FOR LESS ADVANCED COUNTRIES. SOURCE: INTERNATIONAL MONETARY FUND.

limited supply

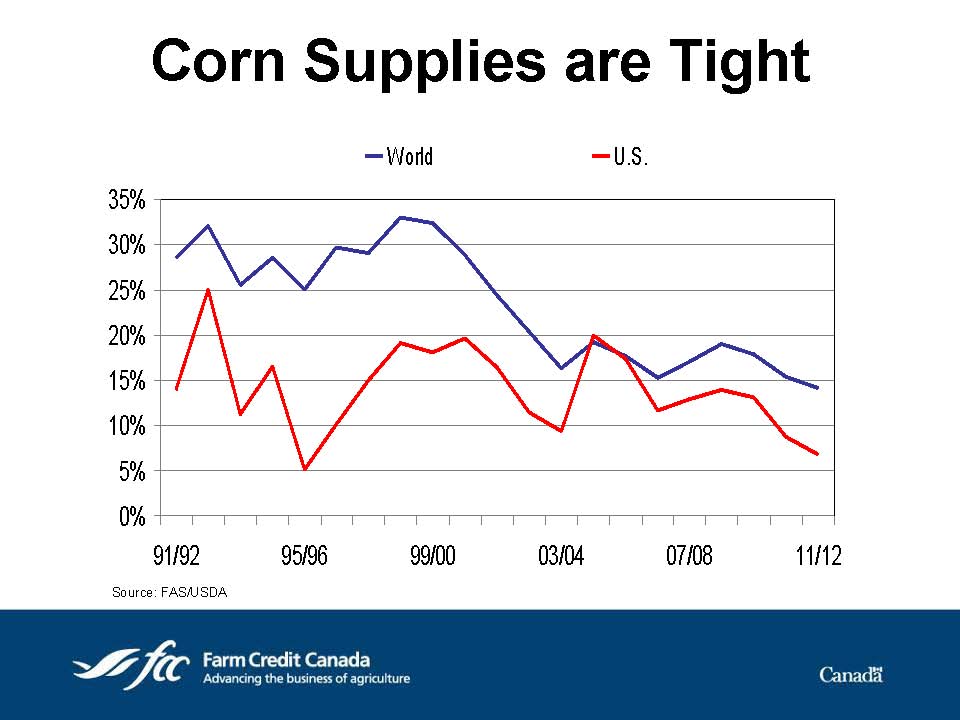

Having the supply on-hand to fill new markets will be another challenge. All forecasts for 2012 suggest that supply will continue to be tight, especially for corn. Alfons Weersink, economics professor in the University of Guelph’s Department of Food, Agricultural and Resource Economics, points to downward trends in the stocks-to-use ratios for corn to illustrate this point (Figure 3). “The corn supply relative to demand is low by historical standards, making markets really edgy,” Weersink says. That means any system shock, such as a weather scare, could send market prices higher.

FIGURE 3: STOCK TO USE RATIO IS ONLY TIGHTER IN THE LAST 20 YEARS. CURRENT STOCK TO USE RATIOS FOR CORN ARE AT 6.7%

Changes in the US biofuels policy, which went into effect December 31, 2011, should have minimal impact on freeing up corn supply say both Gervais and Weersink. While biofuel tax credits will disappear, the huge production capacity will still exist in the mid-US for corn ethanol production. These plants are typically able to be profitable without tax incentives. With an appetite for 40 percent of the US corn crop, corn ethanol production will continue to put pressure on an already tight crop supply. And as oil prices increase, there will be more demand for alternative energy sources, which should be positive for grain farmers.

“The link between corn and oil is not the bad news we used to think,” says Weersink, describing how a shift of oil prices in either direction can be positive for growers. “While higher oil prices will increase fuel and fertilizer prices for crop producers, the link to the ethanol market means that it will also push up prices for corn and soybeans.”

For grain farmers, the forecast of increased demand for tight supply should be positive. The key will be finding the profit balance within a volatile market situation.

external influences

The global market volatility should keep interest rates low. Gervais doesn’t expect rates to climb until the second quarter of 2012 at the earliest. Inflation is expected to edge downward, as it’s currently above the Bank of Canada’s two percent target. Lower inflation rates should also put downward pressure on farm input costs such as energy and fertilizer.

The US dollar continues to be the currency investors go to in times of economic uncertainty, Weersink says. This is expected to keep the Canadian dollar to close to parity with the US. The tight supply and Europe’s financial crisis will make crop prices especially volatile, much like 2011. Yet, on average, growers that are able to ride through the highs and lows should achieve a solid average return. The outlook for crop prices is positive but the increased variability in prices puts more importance on managing the price swings.

comprehensive risk management

Gervais encourages farmers to work on risk management plans as an important way to manage volatility. “Run through ‘what if’ scenarios,” he says. “What if your major buyer moves in a different direction?” Consider all the possible risks that could impact your business including input costs, revenues and customers, and determine ways to adapt. As farms get bigger and more complex, Gervais says it’s important to work on more comprehensive risk management plans, and keep evolving these plans more frequently than once per year.

Both Gervais and Weersink say 2012 is not the time to relax. Continued innovation, production efficiencies and investments in technology and research are needed. These advances will continue to put growers in the best position to make the most of doors opening to emerging markets. The opportunities are there. •