Global economic outlook

MARKET INFLUENCES IN 2013

the global economy continued to experience a weaker performance at the end of 2012 and will likely continue on the same note throughout 2013. Current macro trends will also continue to shape the economic climate for the year to come. Here is a brief outline of some of the factors influencing several key markets.

european union

European economic growth will likely remain low in 2013. There are indications in some European circles that the current conditions are ripe for a “self-fulfilling fiscal crisis” – meaning investor’s outlooks are triggering a self-fulfilling prophecy. Investors’ pessimistic or optimistic expectations are largely based on a country’s perceived reputation. Greece, Italy and Spain are among the countries with the highest debt in the European Union (EU), and are now at the mercy of investors. They exceeded their capacity to service debt and other obligations, leaving their solvency dependant on investors’ expectations.

This scenario is a viscous cycle. If investors believe that a government can manage and service its debt on time, then they’ll perceive the country as less risky and accept lower interest rates. Alternatively, if investors start to question a government’s ability to fulfill its debt obligations, then they’ll demand higher interest rates on their investments. A higher interest rate is what’s causing the insolvency issue in the first place. The response from EU policy makers, thus far, has been to provide ample liquidity to the troubled countries via the European Central Bank (ECB); thereby helping to calm markets down and keep investor expectations at bay.

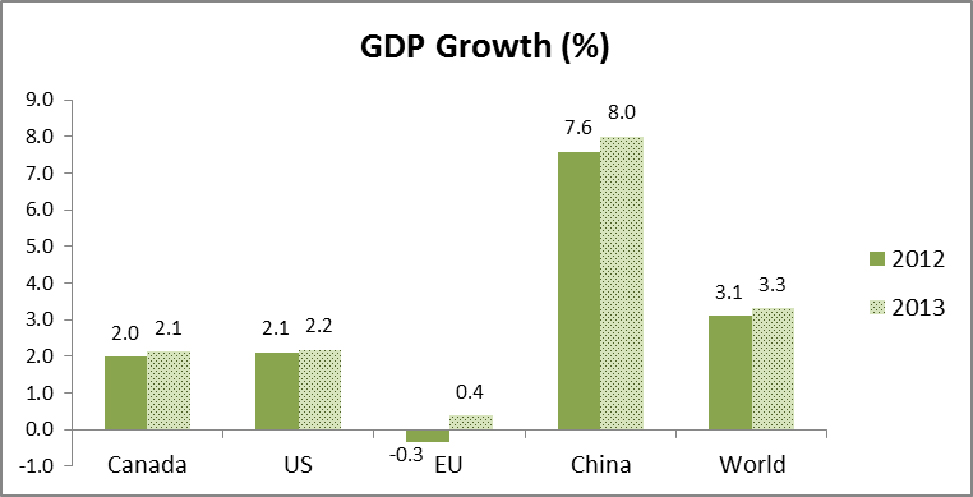

TABLE 1: GDP GROWTH

France is now facing such a scenario. The European giant is starting to feel the ground shake beneath its feet. For years, the world’s fifth largest economy and sixth biggest exporter has been losing competitiveness to neighbouring Germany, especially in the labour market. Without the option to devalue its currency, the French government has resorted to spending beyond its means – growing its debt to compensate for the weakening job market. Unemployment in the country is nearly 10%, with youth unemployment particularly high at an estimated 25%. Government spending is estimated at 57% of gross domestic product (GDP) and debt at more than 90% of GDP. Adding France’s contribution to the European Central Bank to its national debt obligations would put the debt-to-GDP ratio even higher. Outdated policy has severely impacted the business environment with overly regulated industries and higher taxes than many European counterparts, leaving would-be entrepreneurs frustrated and small to medium sized businesses struggling. France’s solvency may be at the mercy of investors, but its survival is in the hands of its politicians. The recently elected President François Hollande has the big task of leading the much needed policy reform.

united states

The US economy is unlikely to escape the current anemic growth rate in 2013 with an estimated annual GDP growth of less than 2%. The US economy is likely to be influenced by developments in Europe and China. The result of a status quo election and a global economy lacking boost will keep radical fiscal or monetary policy from materializing in the near term. The Federal Reserve has already indicated its commitment to maintaining a low interest rate environment, which has been beneficial to the US housing and auto sector, and will likely continue to do so in 2013.

china

The Chinese economy is likely to continue expanding at merely half the pace of the pre-recession levels in 2013. Economic symptoms in the EU and US seem to be finding their way to emerging economies like China. The Chinese economy has been softening recently with growth estimated at less than 8%, essentially just above crisis levels.

China’s new leadership roster, including Xi Jinping and seven other elected members (all veterans of the communist party), will take full effect in March. The new leadership likely won’t have the world on edge; the government’s track record suggests there will be more of the same ‘Chinese Moderation’. While moderation has been fairly new territory, the Chinese government is becoming more familiar with it. Achieving this ‘moderation’ status is the key to survival, and that seems to be the direction the new leadership is heading in.

After a strong rebound in 2010 and 2011, China’s growth is dependent on its ability to adapt and manage lower, but more sustainable growth levels and maintain national social stability as a priority. In turn, the lower growth in China is spilling over to the chain of Chinese trading partners, especially other emerging Asian and South American economies.

canada

The Canadian economy is likely to continue growing at a slow pace of just over 2% GDP. Canada’s economy appears to be a mixed basket; while it generally possesses strong fundamentals it’s not entirely immune to the weakening global demand of its main trading partners the US and China. A rising dollar has also added pressure to various export sectors. Some regional economies have benefited from the exchange rate, namely resource-heavy provinces in Western Canada. Alberta’s economy will continue to lead the pack across a range of indicators with solid growth throughout 2013, supported by robust oil sands investment. Alberta is likely to see the bright side of 3% growth in 2013. Canada’s central bank is flirting with the idea of raising interest rates, but the scenario seems unlikely given the slow national growth and the struggling US economy.

middle east

In addition to the risks in the US, EU and China, there is the ongoing high tide of political unrest in the Middle East; the wildcard. The Levant region, characterized by countries like Syria, Palestine and Israel, are geographically strategic and tend to rank high on many Eastern and Western political agendas. Oil producing countries like Iraq and Iran are the other side of the coin, with ongoing turmoil in Iraq and economic sanctions on Iran’s oil industry at the helm of much of the conflict. The continued tensions will likely play out unfavourably; raising energy costs across the board if the situation destabilizes significantly.

weather and commodities

Recent droughts in the US Midwest and similar weather conditions elsewhere in South America and Eastern Europe will have a more pronounced effect on the stocks of input and intermediate goods this year. Some of the aforementioned will find its way down to consumer finished goods on supermarket shelves in 2013. The weather-driven commodity price may be further amplified due to its strong ties to oil prices. •