Q2 2023 Macroeconomic snapshot: Strength today, weakness tomorrow

Signs of economic and financial stress emerged in mid-March in the US and Swiss banking sectors, startling financial markets, sending yield curves temporarily lower, and complicating the economic outlook. Q1 GDP growth in Canada showed unexpected strength, while Canada’s inflation rate in April showed (unfortunate) resilience. In this quarter’s Economic and Financial Market Update, we explain what it all means.

Economic growth has been surprisingly strong, but storm clouds are brewing

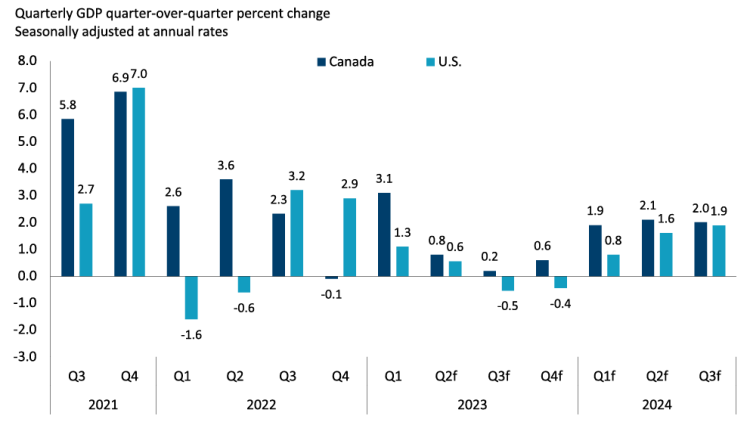

Strength in consumer spending has surprised markets considering the fastest interest rate tightening cycle and worst cost-of-living crisis in a generation. Canada’s economy grew in Q1 at an annualized rate of 3.1%, largely because of strong household spending.

Consumer cash flow has been managed by a combination of increased credit card debt, extended amortizations on variable rate mortgages (as the Bank of Canada recently warned), a drawdown of savings accumulated during the pandemic, and improved nominal wage growth. How long this can continue is an important consideration when looking at future growth: while employee compensation has continued to increase in 2023, both household disposable income and the household savings rate have declined (the latter dropping from 5.8% to 2.9% last quarter). Labour markets are still strong but ebbing. The latest Bank of Canada Business Outlook Survey indicates that firms are less concerned about labour shortages than six months ago.

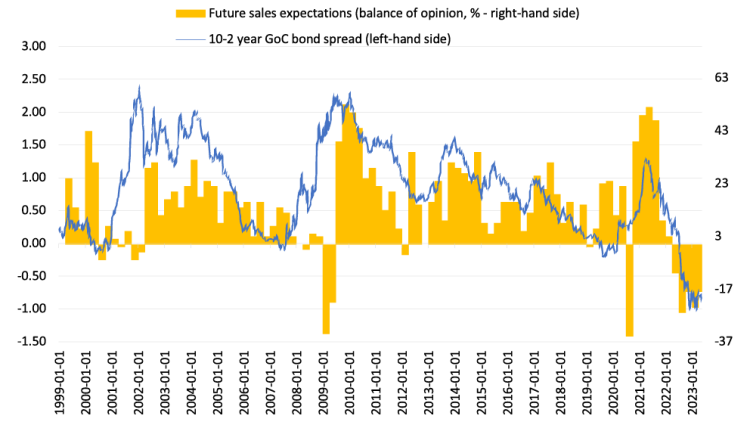

As highlighted in Q4 2022, the yield curve is still extremely inverted, often a precursor for a recession. When paired with business expectations of future sales from the Business Outlook Survey, we are in uncharted territory: neither metric has been this negative for this long, including during the financial crisis of 2008-09 and the pandemic-induced recession of 2020. This points to an economic downturn ahead; the only questions are when and how deep it will be.

Figure 1. The inverted yield curve and business expectations of future sales indicate a downturn ahead

Sources: Statistics Canada and Bank of Canada Business Outlook Survey

The 10-2-year GoC (Government of Canada) bond spread is the difference in the yield of the 10-year bond minus the yield on the 2-year bond. When negative, the yield on the 2-year bond is higher than the 10-year.

FCC Economics expects Canadian economic growth will weaken sharply after the strong Q1 burst, as US-related trade headwinds complement the hit to the domestic economy stemming from the lagged impacts of earlier interest rate hikes from the BoC.

Figure 2. FCC Economics expects growth to weaken for the remainder of 2023

Sources: FCC Economics, Bloomberg

Will the Bank of Canada do more to fight inflation?

On June 7 the BoC elected to raise its overnight interest rate by 25 basis points, bringing it to 4.75%. Recent robust data releases (including Q1 GDP and April CPI) prompted the BoC to act. While additional rate hikes are possible, it seems to us that the rate hike cycle is close to peaking - FCC Economics expects the overnight rate to remain at 4.75% for the rest of 2023.

Table 1. BoC to hold overnight rate steady for the rest of the year

Sources: FCC Economics, Bank of Canada, The Federal Reserve

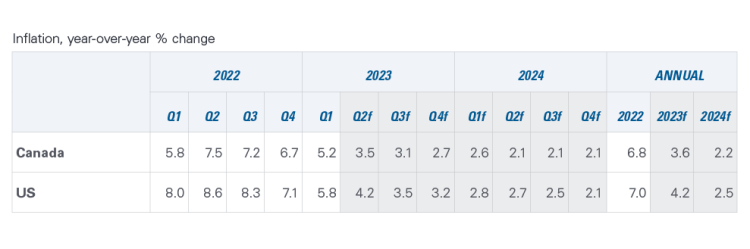

The BoC has continuously reiterated its commitment to reining in inflation to 2%. While April’s year-over-year inflation rate (4.4%) was slightly higher than March, below the surface, some data suggest inflation is heading in the right direction.

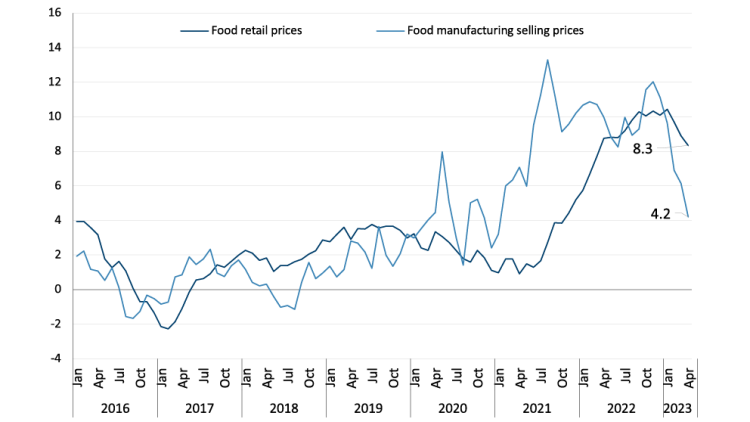

For the last 17 months, food inflation has been higher than overall inflation. Indeed, with a weighting of nearly 16% in the CPI calculation, food inflation has contributed to the overall inflation rate. There’s an approximate eight-month lag between food manufacturing and retail prices. Food manufacturing price inflation has decelerated rapidly in the last three months, falling from 9.6% to 4.2%. Food retail price inflation should ease in the fall and early winter, given that this historical relationship holds and assuming downward pressure on food manufacturing prices continues.

Figure 3. Food manufacturing inflation is decelerating rapidly

Source: Statistics Canada

Overall, we expect inflation to decline towards 3% by the end of the year and towards 2% in mid-2024.

Table 2. Headline inflation is forecasted to decline further in 2023

Sources: Bloomberg, Statistics Canada, FCC Economics

Fixed rates to decline in late 2023, early 2024

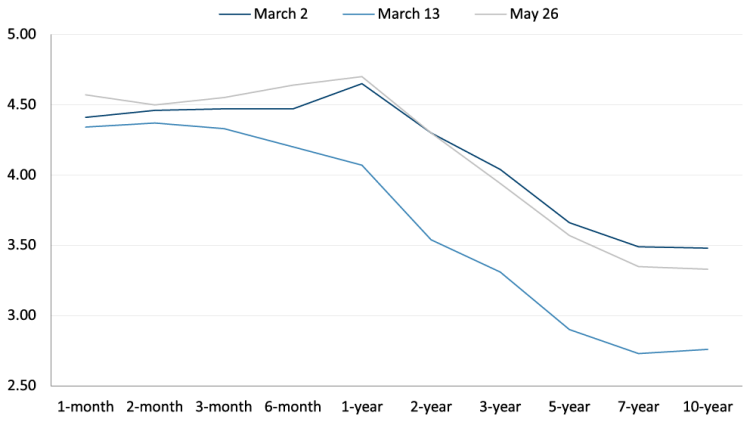

The banking crisis in the US and Europe caused great economic uncertainty, resulting in risk-averse investors directing their money towards less-risky assets like government bonds. This happened mid-March as the Government of Canada (GoC) yield curve shifted down, relative to where it was before the crisis. However, as the situation in the US appeared to stabilize, and after April’s CPI numbers were released, the yield curve shifted back up – roughly in line with where it was at the beginning of March.

Figure 4. GoC yields fell in March but reverted as concerns of bank failures subsided

Source: Statistics Canada

That said, the recent shift higher will be short-lived. FCC Economics expects bond rates to fall throughout the year – especially on the short end of the curve (e.g., on maturities of two years or less) as growth and inflation slow and the BoC looks to start cutting its overnight rate in 2024.

Table 3. Long-term rates are expected to decrease in the second half of 2023

Sources: Statistics Canada (historical), Major financial institution consensus (forecast)

Exchange rates and foreign market commentary

USD per CAD

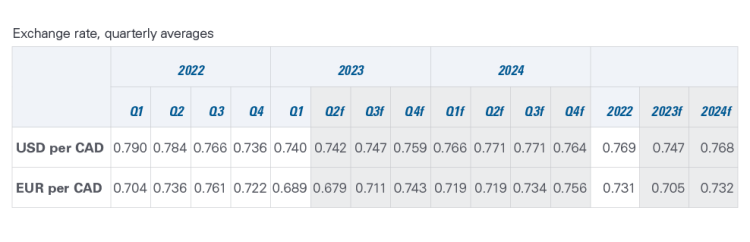

Despite all the financial market turmoil — including a last-minute deal to avert a US government default — the Canadian dollar has been steady this year. We expect this to remain the case for the rest of 2023 and into 2024.

EUR per CAD

By comparison, we see some upside in the Canadian dollar relative to the Euro in the latter half of 2023 and into 2024. Germany, the Euro zone’s largest economy, recently entered a technical recession. Inflation has been more stubborn in the Euro zone than in Canada, and the European Central Bank (ECB) has been slower and less aggressive in raising its key policy rate than compared to the BoC.

Table 4. CAD is projected to hover around the 74 to 77 range over the next six quarters

Sources: FCC Economics, Statistics Canada

Senior Economist

Graeme Crosbie is a senior economist at FCC. His focus areas include macroeconomic analysis and insights and monitoring and analyzing Canada’s food and beverage industries. Having grown up on a dairy farm in southern Saskatchewan, he occasionally comments on the health of the dairy industry in Canada.

Graeme has been at FCC since 2013, spending most of that time in risk management. Graeme holds a master of science in financial economics from Cardiff University and is a CFA charter holder.