U.S. files WTO complaint

CHINA'S GRAIN SUPPORTS AT ISSUE

CHARGING THAT CHINA’S market price supports create government incentives for Chinese farmers to ramp up corn, wheat, and rice production, the United States has initiated a new trade enforcement action against China. In 2015, China’s supports inflated the country’s domestic prices for these grains by almost $100 billion (U.S.) above the levels China agreed on when it joined the World Trade Organization (WTO), according to an announcement from the Office of the U.S. Trade Representative (OTR). That created artificial incentives to increase Chinese production of corn, wheat, Japonica rice, and Indica rice.

“These programs… undercut American farmers and clearly break the limits China committed to when they joined the WTO,” says Michael Froman, U.S. trade representative.

“Wheat production subsidies in China and other advanced developing countries are the single biggest policy issue affecting our farm gate prices and global trade flows,” says U.S. Wheat President Alan Tracy.

Each year, China announces the minimum price at which the government will purchase the four affected commodities during harvest in major producing provinces. This system has maintained domestic Chinese prices at levels above world market prices since 2012, encouraging Chinese farmers to produce more grain and distorting the market.

When it joined the WTO, China agreed to hold its domestic supports to 8.5% or less for each grain; but in practice, Chinese supports have exceeded agreed levels for every year since 2012.

In addition to price supports, China is believed to be subsidizing input costs such as seed and fertilizer.

The trade enforcement action is the result of a five-year investigative effort by the OTR and industry partners — including U.S. Wheat Associates (USW) and the National Association of Wheat Growers (NAWG) — to demonstrate how Chinese policies hurt U.S. farmers. According to research in 2015 and 2016 by economists at Iowa State University (ISU), China’s programs cost U.S. farmers from $650 to $700 million in lost income each year by suppressing global grain prices and pre-empting export opportunities.

China’s minimum procurement price of about $10 per bushel for wheat is so high that the Chinese government must purchase and store huge stocks of domestic wheat, according to a 2014 study by DTB Associates, sponsored by USW. As a result, the U.S. Department of Agriculture estimates that by June 2017 China will hold 44% of the world’s wheat stocks — a record level that will further depress market prices.

The Iowa State analysis also compared the effects of current Chinese supports with a new scenario in which the current supports are removed.

“This [alternative scenario] would benefit farmers in the United States and other wheat exporting countries as China would need to increase its imports by more than nine million metric tons (330 million bushels),” reported Dr. Dermot Hayes, ISU agricultural economist. “The corresponding lift in wheat exports would increase U.S. farm income from wheat by 19 cents per bushel.”

Hayes’ research also suggests that ending the Chinese subsidies could increase Canada’s wheat exports by 1.5% and improve global wheat prices by 2.8%.

This WTO case is the 23rd enforcement action that the U.S. trade representative has initiated since 2009, and the 14th case brought against China. The U.S. has won every case that has been decided to date.

U.S. negotiators are now working through the WTO’s official consultation process to try to resolve the dispute. This process requires China to meet with U.S. negotiators within 60 days to address the complaint. After that, there are additional steps, including appeal options making it likely that it will take several years to reach a solution.

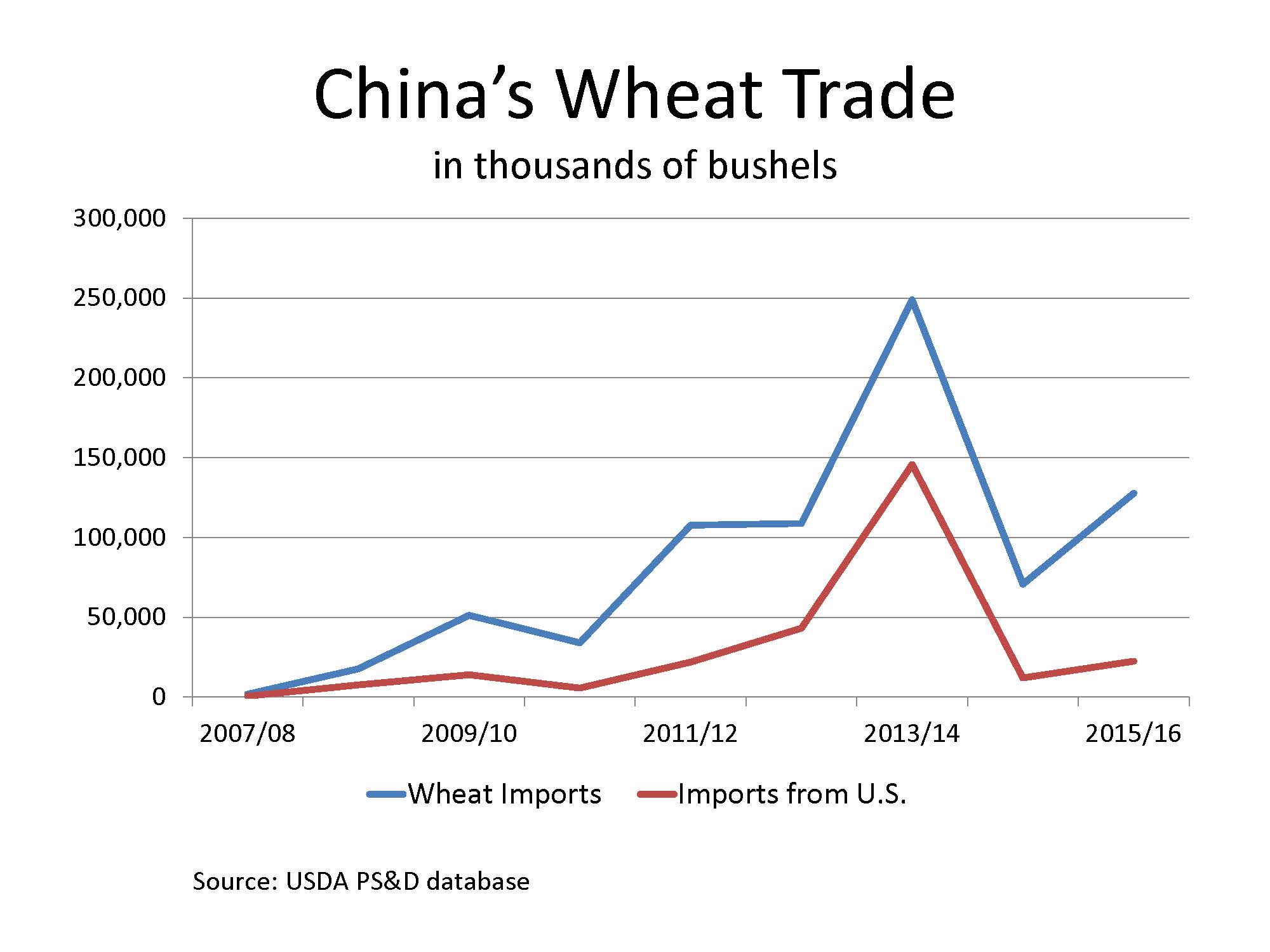

U.S. wheat exports to China have varied widely in recent years (see graph). In 2013/14, China was the number one market for U.S. overseas wheat sales, which totaled almost 155 million bushels. In 2014/15, sales dropped to just over 12 million bushels, and China’s market rank fell to 17th in the world.

CHINA – U.S. DDGS DISPUTE

In a separate dispute from the World Trade Organization case, the United States and China are butting heads over U.S. sales of Dried Distillers Grains with Solubles (DDGS) from ethanol production to China’s feed manufacturing industry.

China is the leading world market for U.S. DDGS. Sales, which totaled $351.1 million in 2011, were nearly $1.5 billion in 2015.

An ongoing investigation, initiated early in 2016, led China to claim that U.S. policies have adversely affected Chinese DDGS producers, and on September 23, China’s Ministry of Commerce (MOFCOM) issued a preliminary duty of 33.8% based on anti-dumping claims. It was followed on September 28 by a countervailing duty of 10 to 10.7%, depending on the DDGS producer. Both duties went into effect immediately and are due when U.S.-originated DDGS shipments arrive in China.

The Office of the U.S. Trade Representative, the U.S. Grains Council, and the U.S. ethanol and DDGS industries have strongly disputed Chinese anti-dumping and countervailing duty claims. China has made attempts in previous years to restrict U.S. DDGS sales by imposing similar duties.

The DDGS actions were announced just 10 days after the U.S. corn, wheat, and rice subsidy complaint was filed. •