2020 grains, oilseeds, and pulse outlook update

PRICES EXPECTED TO IMPROVE OVER NEXT 6 MONTHS

This Grains and Oilseeds Outlook was released on November 3, 2020. The next Grains and Oilseeds Industry Outlook will be available January 2021.

FCC Ag Economics will update its projections about profitability across three Canadian agriculture sectors (red meat, dairy, and grains, oilseeds and pulse) throughout October. We’ll describe what has happened in 2020 to-date and what to monitor over the next six months.

IN OUR FEBRUARY 2020 Grains, Oilseeds and Pulses Outlook, we identified three factors likely to impact profitability:

- Trade tensions’ influence on agri-food markets

- African Swine Fever’s (ASF) disruption of livestock and meat markets

- Large global supplies amid challenging growing conditions for crops

RECAP OF THE FIRST NINE MONTHS

The first nine months of 2020 have been challenging for grains, oilseeds, and pulse producers. The year began with significant concern due to 2019 harvest challenges, numerous trade issues, including canola, durum, peas, and lentils.

Then COVID-19 led to closures of processing facilities and ports worldwide, which, combined with trade restrictions, raised questions around trade flows. Some concerns quickly alleviated as reduced rail demand created increased capacity for grains, oilseeds, and pulses. Reductions in Indian import tariffs on Canadian lentils supported prices, while canola exports traditionally destined for China found opportunities in Europe.

In Western Canada, favourable weather allowed for the 2020 harvest to be completed ahead of normal with average to above-average yields. In Eastern Canada, timely rains have supported corn and soybeans. However, the smaller grains’ production was poor.

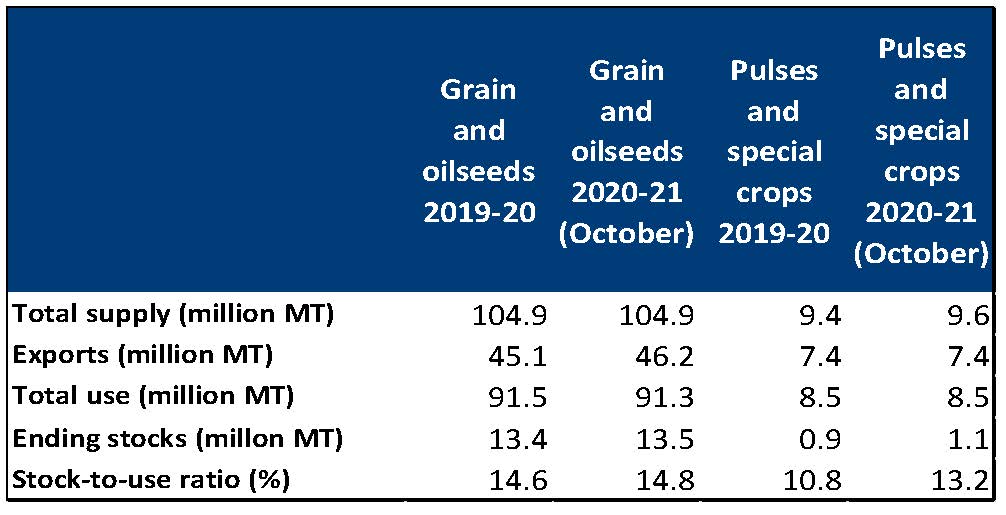

Strong Chinese purchases and lower expected supplies in the U.S. are supporting producer prices, especially oilseed prices. Through the first nine months of 2020, producer deliveries were 13.6% higher than in the same period in 2019, and exports are 2.3% higher, according to the Canadian Grain Commission.

Our revised price projections (Table 1) indicate stronger oilseed prices, while pulse and grains prices will be mixed. Canola and soybean prices are projected to stay higher than the first nine months of 2020 and their five-year average. India’s decision to reduce import tariffs on Canadian lentils will continue to support lentil prices, while pea prices will struggle if Indian import tariffs remain. Corn and spring wheat prices are anticipated to trend higher than the five-year average, while barley prices remain similar or slightly higher. Overall, the outlook has improved from our July 2020 update.

TRENDS TO MONITOR IN THE NEXT SIX MONTHS

- U.S. stock-to-use ratios and global demand

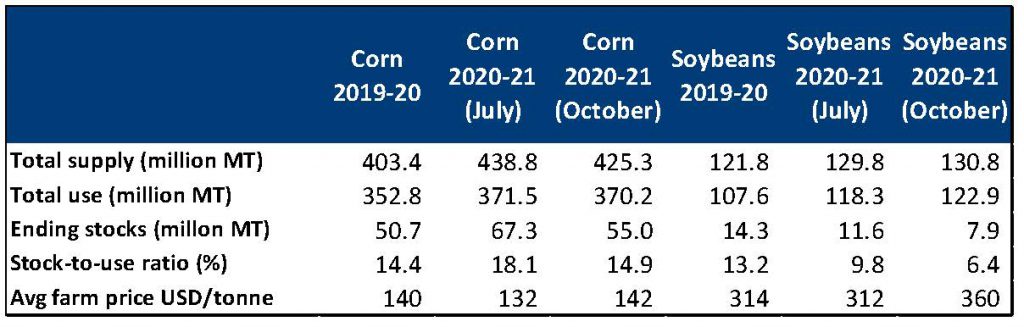

U.S. stock-to-use ratios have declined for wheat, corn, and soybeans according to the most recent United States Department of Agriculture (USDA) WASDE report, increasing price projections (Table 2). Drought across several U.S. states has lower corn production forecast. As global economies re-open and China rebuilds its domestic hog herd, export opportunities are expected to improve. Tighter corn supply and stronger export demand are supportive of North American prices, especially for oilseeds.

- Canadian production vs strength in export demand

Canadian corn, soybean, pulse, and wheat production is estimated to be higher than last year by Statistics Canada. Conversely, canola and barley production could slightly decline. An important fundamental trend to monitor will be how the preliminary production story evolves as final production numbers are updated. Currently, there are discrepancies between Statistics Canada and provincial production estimates in Western Canada. Alberta and Saskatchewan are reporting improved yields in 2020; however, they are below Statistics Canada estimates. If provincial expectations are correct, we could see production numbers revised lower.

- Economic rebound is slowing down

A second wave of COVID-19 has emerged globally. It can slow the re-opening of economies, limiting demand for food services and fuel. This could negatively impact the demand for cooking oils and ethanol.

The October IMF economic projections suggest a long ascent towards the level of economic activity prevailing before the pandemic. A slower recovery for the Canadian economy in the second half of 2020 means that interest rates will remain near historical lows for quite some time. World GDP is expected to contract by 4.4% in 2020 and rebound 5.2% in 2021. China is a notable exception, as it’s still expected to grow (1.9% in 2020 vs. the 6.5% annual growth observed in recent years). It is projected to rebound by 8.2% in 2021. China’s economic ability to deliver on its Phase 1 trade agreement with the U.S. can boost global grain and oilseed prices.

Craig Klemmer is the principal agricultural economist for Farm Credit Canada. •