A formidable competitor

UKRAINE INCREASING GRAIN EXPORT SALES

long recognized as as a major wheat and barley producer, Ukraine is evolving into an important source of corn and soybeans and a “formidable competitor” for regional export sales, according to Ukrainian sources and grain industry experts.

Ukrainian officials suggest their country will be the seventh largest grain exporter in the world in 2012-13, according to the president of the Ukrainian Grain Association (UGA), Volodymyr Klymenko. The UGA predicts exports will total more than 22 million metric tonnes (mmt), an estimate supported by projections made by the US Department of Agriculture (USDA). At least four mmt will go to China as part of a 2012 agreement to supply up to six mmt of grain to China annually for a 15-year period.

The USDA’s March World Agricultural Supply and Demand Estimates puts Ukraine’s wheat sales at 6.5 mmt and coarse grain sales (barley, corn, sorghum, oats, rye, millet and mixed grains) at 21.7 mmt. That could still leave Ukraine with almost five mmt in grain ending stocks.

Meanwhile, Mykola Prysiazhniuk, Ukraine’s agricultural policy minister, says his country intends to join discussions over creating an association of the world’s largest grain producers known as “the grain twenty.”

“Ukraine is definitely in expansion mode,” says Cary Sifferath, the US Grains Council director who monitors the region.

Ukraine’s great agricultural resources, especially its black earth (or chernozem), are just one factor contributing to its growing export strength. Reaching across two-thirds of the nation, the highly productive chernozem soil ranges from a foot deep to as much as 150 inches, is comprised of up to 15 percent humus, and is generally well-drained. The continental climate means growing conditions are similar to the upper regions of the US Corn Belt.

Still, this productive potential was never fully realized under the Soviet Union’s top-down system of management, which left land underutilized and the agricultural economy undercapitalized. Now a mix of policy changes and sector investments are helping modernize Ukraine’s grain and oilseed sectors. Among the improvements:

- Ukrainian and foreign investors have built new port facilities to significantly expand the country’s export capacity. According to Sifferath, Ukraine now has enough capacity to handle its current export levels and is still building to meet future demand.

- Ukrainian farms are increasingly adopting the use of chemicals and fertilizers to increase yields, and foreign loans are expected to underwrite construction of a fertilizer plant and purchases of seed and equipment.

- This year, Ukraine’s laws will finally permit the sale of farm land, potentially allowing the thousands of five- to 12-acre farms created after the fall of Communism to be combined into more productive units that can afford better technology. Currently only 8,500 farms out of an estimated 50,000 have the resources to be competitive in world markets.

- The Chicago Mercantile Exchange established its first futures contract based on Black Sea region grains last year and a Black Sea corn futures contract could follow.

- Ukraine’s government is emphasizing exports as a means of earning foreign currency. Among its target markets is Egypt, the world’s largest wheat importer and a significant corn importer.

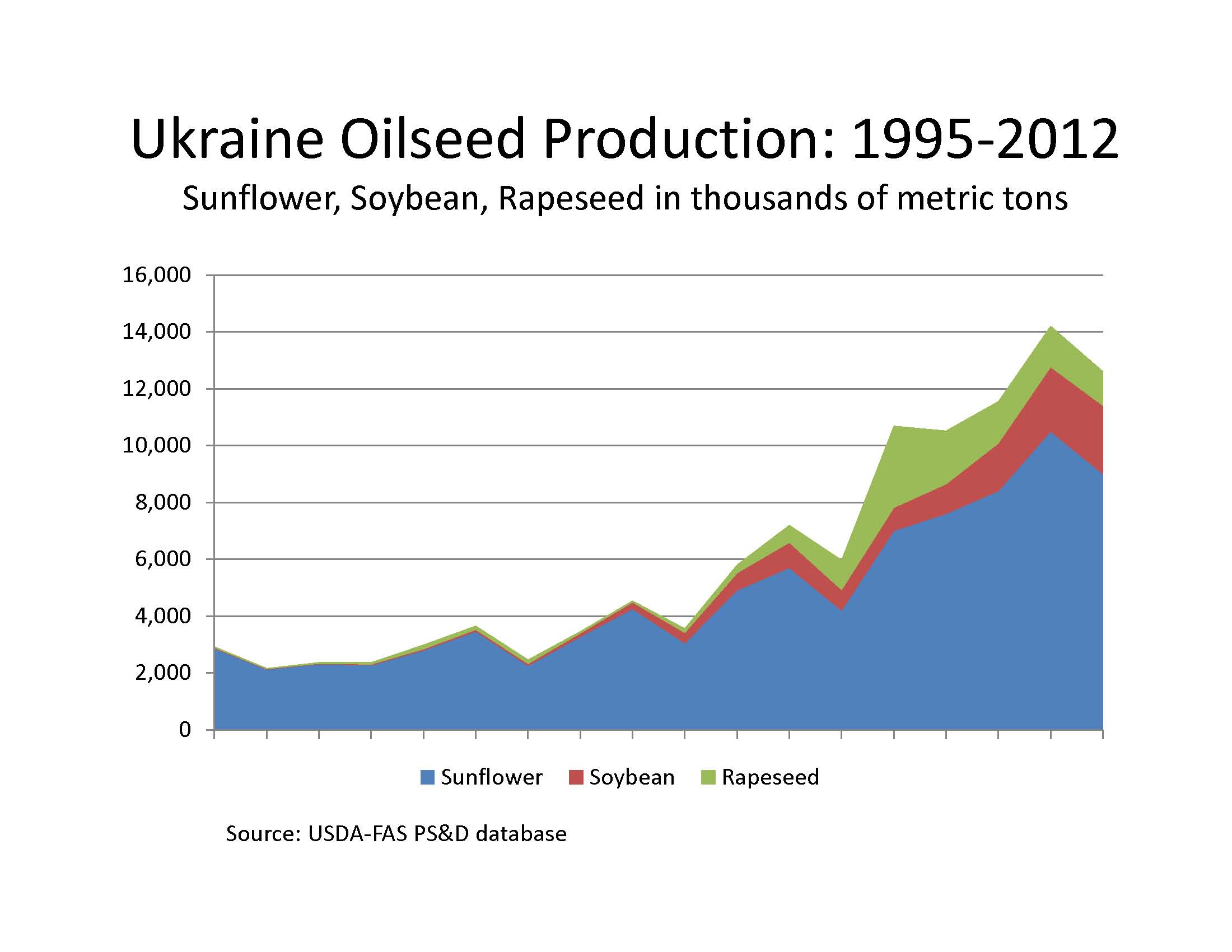

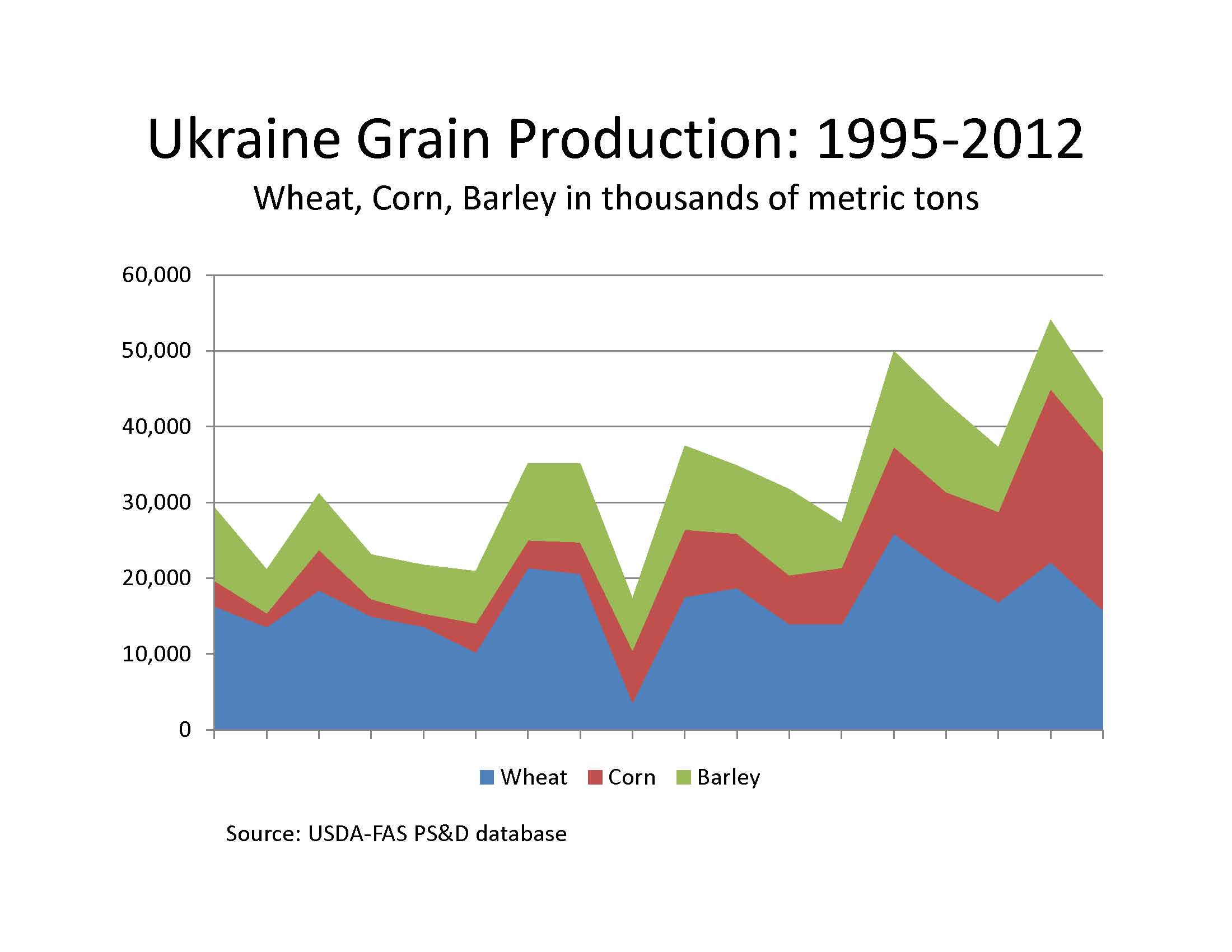

- Ukraine is producing more corn and soybeans (see graphs), and improving corn yields are nearing Argentine levels. Since producing just 6.3 mmt of corn in 2006-07, Ukraine’s output has almost quadrupled. Last market year, corn exports totaled 15.2 mmt, making Ukraine the world’s fourth largest corn exporter. Though starting from a lower base, soybean production is also up, more than tripling in the past five years.

“We’re seeing acres shift from barley, and sometimes from wheat, into corn,” says Sifferath. “Farmers are seeing a better return on corn, soybeans, and sunflowers than on wheat and barley.”

Major challenges remain if Ukraine is to finally realize its full agricultural potential. More efficient management and land use are critical, corruption is an ongoing issue, and farmers still lack on-farm storage and marketing alternatives. Even so, Ukraine has become a more important competitor for export sales, and not just in the Eastern Mediterranean, according to Sifferath. “They are supplying corn to Spain, Portugal and Israel and lesser amounts to Algeria and Morocco,” he says. “Ukrainian barley continues to be a big factor going to Saudi Arabia.” Ukraine also exports to major Asian markets like Japan and South Korea and is building long-term trade ties with China.

In extended projections, the USDA foresees continued growth in Ukraine’s grain and oilseeds output: by 2021-22, corn production up 23% and exports up 32%; soybean production up 42% and exports up 51%; while at the same time Ukraine should maintain its traditional role as a wheat producer with output up 45%. •