Understanding tax changes

KEY NOTES FOR INCORPORATED BUSINESSES

TAXATION IS COMPLEX at the best of times. But recent changes to the taxation of incorporated businesses, which includes many farms, has made it even more complicated. In July last year, the federal government released a set of proposed changes that, in their view, would tighten unfair advantages that incorporated businesses had.

The initial proposals were complicated, punitive, and relied heavily on “reasonableness tests” by the Canada Revenue Agency (CRA) to determine if a tax was owed or not. The reaction from the business community, including farmers, was immediate and strong. After taking considerable heat from all quarters, the government backed down on some of the proposals and simplified others. The following is a brief and very simplified overview of the changes. If you think you might be impacted you should contact your tax advisor.

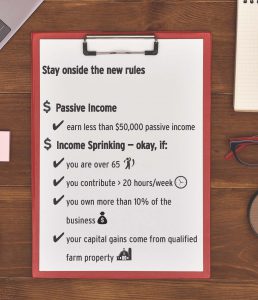

The changes will impact two areas: income sprinkling and passive income.

INCOME SPRINKLING

Income sprinkling is simply the splitting of income between individuals in order to achieve an overall lower tax rate. Typically, incorporated businesses might pay family members who are shareholders through dividends or income which in effect splits the profits of the corporation to family members who are in a lower personal tax bracket. In the case of salaries to family members these must be considered reasonable.

Income splitting is not illegal or even unethical. It is clearly encouraged by the Income Tax Act (ITA) in certain instances, such as the splitting of pension income between spouses. And all of us are allowed to arrange our affairs in such a way as to pay the least amount of tax.

TAX ON SPLIT INCOME (TOSI)

This part is going to get a bit technical but will help you understand how the government went about the changes. The ITA already discourages income splitting with children under the age of 18 by taxing the income that minors receive from related individuals at the highest marginal rate of personal tax — thus eliminating any advantage of splitting income. These rules are referred to as “tax on split income” or TOSI and were aimed at preventing income splitting with minor children.

When the government decided to go after corporate income splitting they greatly expanded the existing TOSI provisions to include new age groups and definitions of income. These new rules now, in effect, include so-called “bright-line” tests to exclude certain individuals from the TOSI rules. So you are caught unless you can fit into one of the exemption tests.

EXEMPTIONS

If you are a shareholder in an incorporated business you can be exempted from the new rules in the following circumstance:

- Spouse of business owner who is over 65 — If a business owner is over 65 (and has contributed to the business) income can be split with a spouse of any age. This aligns with the current pension splitting rules.

- Labour contribution — An exemption is allowed for adults aged 18 or over who are actively engaged in the business. This is defined as working in the business for at least 20 hours per week during the portion of the year that the business is operational, or during any five previous years. This latter portion of the exemption is important. It does not need to be consecutive years and once the five year threshold is reached you don’t have to qualify each year. You are good for the life of the business.

- Capital contribution — this one depends on your age. If you are between 18 to 24 years of age you must have contributed to a family business to be exempt. There are two ways to do this. One is by contributing your own capital. On this capital contribution you are allowed a reasonable return as determined by CRA. The second approach can include non-arm’s length capital, but a prescribed rate of interest that is very low is used which means that you might only be exempted for a small portion of split income.Adults 25 years of age and older are exempted if they own 10 per cent (votes and value) or more of a corporation. There are some rules with respect to the corporation — its business cannot be predominately from services (must be 90% or less) and it cannot be a professional corporation. As an alternative, an individual over 25 could still qualify for an exemption under a reasonable return provision that considers not only historical capital contributions but also other factors such as the work performed, risks assumed, and property contributed.

- Capital gains — Splitting capital gains is also part of the new rules. However, capital gains from qualified small business corporation shares and qualified farm property will be exempted regardless of the age of the shareholder or whether the lifetime capital gains exemption is used. This means that capital gains splitting with non-active family members is still possible, apart from where the existing rules on splitting income with minor children apply.

These changes came into effect as of January 1, 2018, however, businesses have until the end of 2018 to make changes to meet the 10 per cent ownership and voting provisions.

There are also exemptions in circumstance of death, divorce, and inherited property.

PASSIVE INCOME

Passive income is income earned in a corporation from assets that are not used in the active business of the corporation. For example, income from investments of excess cash not needed in the business would be considered passive income. This type of income is taxed at a higher rate within the corporation and is not considered to be active business income eligible for the small business tax rate.

The small business tax rate in Ontario is 13.5% and applies to income under $500,000 earned in a Canadian controlled private corporation. In 2019, it is slated to fall to 12.5%. The tax rate beyond the $500,000 on active income is 26.5% in Ontario. This is a substantial difference.

Under the new rules, passive income that surpasses the $50,000 threshold will reduce the availability of the small business deduction in a graduated fashion ($5 for every $1), until at $150,000 of passive income it will be completely gone.

Existing passive investments will not be grandfathered so any income from those will be included. AgriInvest income will be exempt, but farmland rental income received by corporations will not.

WHAT’S THE IMPACT?

It will vary from farm to farm, however, apart from the obvious tax implications there will be an increase in record keeping requirements for some. CRA has stated that records such as timesheets, schedules, or logbooks retained by either an individual or a business will be needed to establish the number of hours the individual worked in a given year. Where the individual also receives a salary or wages from the business, the CRA would also consider information contained in payroll records that supports the number of hours the individual worked.

If you have questions about the impact of these changes on your farm you should contact your tax advisor.

Rob Gamble is the chief economist for Grain Farmers of Ontario. •