Ontario’s grain and oilseed competitiveness

Industry faces mounting challenges

Ontario’s grain and oilseed farmers continue to face challenging economic conditions. Globally, grain and oilseed prices are under severe downward pressure, driven primarily by supply and demand dynamics in major producing regions.

Canadian grain and oilseed farmers—who are essentially price takers and rely on Chicago futures—remain tied to the U.S. production and trade cycle. For example, the U.S. is anticipating a record corn crop this year, which is putting downward pressure on prices, while China has barely purchased any U.S. soybeans since September. As a result, a potential glut of both corn and soybeans is emerging in the North American market, and grain and oilseed prices are reflecting this future oversupply. Meanwhile, in South America, Brazil’s crop productivity continues to rise each year, and Argentina’s recent cancellation of export taxes has further added to the global supply pressures. China intends to source its purchases exclusively from South America for the foreseeable future. However, as reported in Bloomberg News, uncertainties remain about whether Brazil and Argentina alone can meet this demand.

From a Canadian farmer’s perspective, these market conditions are compounded by policy disparities. The U.S. federal government—and, to a lesser extent, several state governments—have been far more proactive in providing support to their producers, whether through direct farm payments or enhancements to business risk management (BRM) programming. In addition, they have implemented several demand-enhancing measures to stabilize incomes for key field crops.

For instance, the U.S. government has issued ad hoc payments, officially called the Emergency Commodity Assistance Payments (ECAP) under the American Relief Act (ARA, December 2024) and made significant improvements to its Title I commodity programs and crop insurance, both of which were included in the One Big Beautiful Bill (OBBB). The ECAP payments were distributed in spring 2025, followed by the OBBB in July 2025, and another round of ad hoc payments—estimated at approximately $15 billion—is expected this fall. These new payments, targeted primarily at soybean producers (and to a lesser extent, corn and wheat growers), could reach up to $105 per acre.

In addition, the U.S. Environmental Protection Agency has proposed increasing the biomass-based diesel (BBD) renewable volume obligation (RVO) under the Renewable Fuel Standard (RFS) from the current 3.35 billion gallons to 5.25 billion gallons for 2026 and 2027. The proposal also includes adjustments to Renewable Identification Number (RIN) credit allocations that could restrict eligibility for fuels produced with foreign feedstocks. This substantial increase in RVOs is expected to strengthen domestic demand for soybean oil as U.S. crush capacity continues expanding. Tariff uncertainty has already caused Canadian canola oil and BBD exports to the U.S to decline by 33 and 85 per cent, respectively, since March 2025.

In parallel, federal tax changes under the Inflation Reduction Act—specifically, enhancements to the section 45Z clean fuel production credit—are improving incentives for low-carbon ethanol producers. Under modified lifecycle assessment rules that address indirect land use factors, qualifying corn ethanol producers may receive credits of up to $1 per gallon, depending on carbon intensity scores. Lastly, ongoing regulatory efforts to permit nationwide, year-round sales of E15 (gasoline blended with 15 per cent ethanol) by eliminating current summer vapour pressure restrictions are expected to further support biofuel consumption and corn demand.

Taken together, these U.S. policy measures create a highly supportive environment for American producers while placing Canadian farmers at a competitive disadvantage. By stimulating domestic demand and providing substantial direct payments, the U.S. is effectively insulating its farmers from global price pressures, allowing them to capture market share and stabilize incomes. Meanwhile, Canadian producers—without comparable federal support—face lower prices and reduced ability to compete on the global stage, even as some provinces have implemented domestic biofuel mandates. In Ontario, at least 75 per cent of the renewable content required in diesel and 64 per cent in gasoline must be produced domestically. In contrast, in British Columbia, renewable content in diesel is set to rise to 8 per cent by 2025 and in gasoline to 5 per cent by 2026, with both requiring domestic production. While these provincial mandates offer some limited support, they do little to offset the broader competitive pressures, leaving Canada’s grain and oilseed farmers highly exposed to global market shocks and long-term financial uncertainty.

ONTARIO’S CHALLENGING GROWING SEASON

Meanwhile, the current growing season in Ontario has been challenging. Early estimates for corn and soybean harvests present a mixed picture. In some areas, particularly southwestern Ontario, yields for both crops are expected to be normal or slightly above the 10-year average. However, conditions appear far worse in the eastern and central parts of the province. This yield variability is mainly due to dry weather throughout the core growing months of June, July, and August, with some areas receiving less than 60 per cent of average rainfall. Estimates suggest that over 950,000 acres in Ontario were affected by some level of drought this year. Looking ahead to spring 2026, most Ontario producers planting corn and soybean crops are currently filling their input inventories. This may prove challenging, as the cost of primary inputs—particularly fertilizers—remains near record highs in Eastern Canada. Compared to the previous year, urea is nearly 20 per cent higher, UAN is up 23 per cent, MAP is 16 per cent more, and potash has increased by 15 per cent. Fertilizer applications can account for up to 30 per cent of the total production cost in any given year. According to Grain Farmers of Ontario’s Model Farm, if growers stock their fertilizer inventory at current prices for next year’s planting, the average corn grower’s margin would be reduced by nearly $48 per acre—approximately 16 per cent of this year’s operating margin. This does not include potential price declines for corn heading into the next season, which are already low. (Note the Model Farm does not include land rent costs when calculating margin).

Other costs, such as capital expenditures on machinery and equipment, have also risen, increasing 5.27 per cent over the previous year. This is likely driven by tariffs on steel and aluminum imposed by the U.S. on several global trading partners, with Canada heavily affected. The rising machinery costs are reflected in increased depreciation values as well, which have grown by 12 per cent compared to last year—typically a sign that the underlying asset values have risen.

INCOME IMPACTS

The bottom line is that Ontario farmers’ real income (inflation-adjusted) in 2024 fell below 2013 levels, effectively aligning with the 2014–2017 period in real terms, and is far lower than what was achieved during the 2021–2023 growing seasons (see the chart above). This distinction is important: some detractors point to net cash income—also shown in the chart—as evidence that incomes have either increased or remained relatively stable in recent years. However, when depreciation and other adjustments are factored in, the decline in real income between 2023 and 2024 is striking. Early forecasts indicate that 2025 could see an even further deterioration, underscoring the ongoing financial pressures.

Ontario’s farmers face rising trucking costs, overreach by conservation authorities in some regions, municipal stormwater fees, increased obligations under Source Water Protection regulations, and proposed new restrictions on dicamba use, all of which could further challenge their ability to manage their operations efficiently.

In particular, trucking in Ontario has become a significant issue for grain farmers, who face rising costs, reduced access, and growing administrative hurdles that limit their ability to move crops efficiently. The new DriveON vehicle inspection program has tripled safety testing costs and added requirements, such as mandatory “wheel-off” inspections, causing significant expenses and delays—especially in rural areas with fewer licensed garages. Ontario’s complex commercial licensing system adds further costs and time pressures, ignoring the experience most farmers already have operating heavy equipment. Inconsistent municipal load restrictions force farmers to make extra trips and navigate confusing, uneven enforcement. Meanwhile, insurance premiums have surged by 75% over the past decade despite lower collision rates, and barriers for new drivers make it difficult to attract or retain farm truck operators. Together, these issues are undermining farm competitiveness and adding unnecessary strain to Ontario’s grain sector.

BUSINESS CASE: FEDERAL PARTNERSHIP IN ONTARIO’S RISK MANAGEMENT PROGRAM (RMP)

Due to the ongoing economic challenges, Ontario’s provincial government has already stepped up. It has committed to increasing funding for the Risk Management Program (RMP) by $100 million by 2027, ensuring that Ontario farmers have the price support insurance they need to stay competitive. This year, Ontario delivered the first 30 per cent of that commitment, increasing the G&O share by $10.5 million, bringing the government contribution to $63 million for the 2025 season. This will rise to $87.5 million once the remaining 70 per cent of the commitment arrives in 2027.

When producer premiums are included, total funds available for the 2025–26 marketing year rise to $80 million. However, support levels driven by cost-of-production data and lower market prices will generate a pre-harvest liability (the total uncapped payment amount) exceeding $151 million, far beyond current funding levels. If prices remain at similar levels, the post-harvest liability will also be similar. The result will be a 23 per cent proration, meaning farmers receive only a fraction of the coverage they expected.

The RMP is designed as a shared federal–provincial program, with the federal government ideally responsible for 60 per cent of the funding, using the same cost-share model as for other Business Risk Management (BRM) programs. However, in Ontario, farmers have been operating under a program with only provincial participation, limiting coverage to a maximum of 40 per cent of total need, and in practice, actual support is often considerably lower due to program caps.

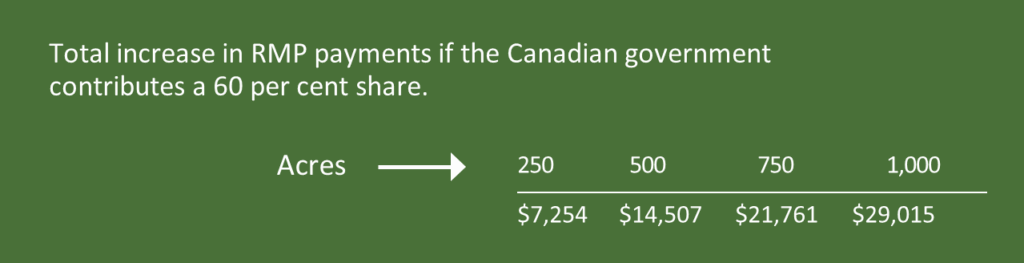

If the federal government contributed its 60 per cent share, Ontario’s RMP funding envelope, under the current program design, would rise from $63 million to $219 million (plus premiums) for the 2025–26 program year. That additional support would ensure that farmers receive payments that more accurately reflect the real cost pressures they face. For example, a 750-acre farm, at current-year prices and support levels, would see its annual RMP support increase by more than $21,000, directly improving operating margins by over 25 per cent. The rise in support for other farm sizes can be seen in the table below:

WHY FEDERAL SUPPORT MATTERS NOW

- U.S. producers continue to benefit from direct income support programs, subsidized crop insurance, and new biofuel and carbon tax credits under federal legislation. This widening disparity in policy support places Canadian grain and oilseed farmers at a competitive disadvantage, as they operate in the same markets without comparable national programs.

- The Province of Ontario has already demonstrated leadership by increasing its RMP contribution by $100 million and continuing to collaborate with producer organizations to strengthen risk management tools. Federal participation would build on this progress and signal a unified federal–provincial commitment to Canadian agriculture.

- Federal investment would directly increase per-acre payments, lower farm debt risk, and bolster business confidence across rural Ontario. It would also align federal actions with stated national objectives of improving food security and fostering a climate-resilient agricultural sector.

PERFECT STORM

Ontario’s grain and oilseed producers are navigating a perfect storm of global market pressures, rising input costs, and domestic policy disparities. While worldwide oversupply and weak demand weigh on prices, Canadian farmers lack the federal support measures enjoyed by U.S. producers, leaving them at a competitive disadvantage. On top of market challenges, Ontario farmers face rising trucking costs, regulatory complexities, and increasing insurance and licensing burdens, all of which further erode operational efficiency and margins. Although the provincial government has taken steps to strengthen the Risk Management Program, federal participation is essential to ensure that support levels reflect the real economic pressures producers face. Without this partnership, farmers’ ability to maintain profitability, invest in their operations, and remain competitive on the global stage will remain severely constrained.

Sankalp Sharma, PhD, is Grain Farmers of Ontario’s senior economist. •