Seed money

THE FUTURE OF TRANSGENIC RESEARCH AND DEVELOPMENT

CROPLIFE CANADA ESTIMATES that it costs nearly $150 million and more than 13 years to bring new biotechnology to market. That makes it a challenge to correctly predict and develop the new seed transgenic traits that farmers will buy into. However, market share within the seed industry indicates several key players must be getting it right.

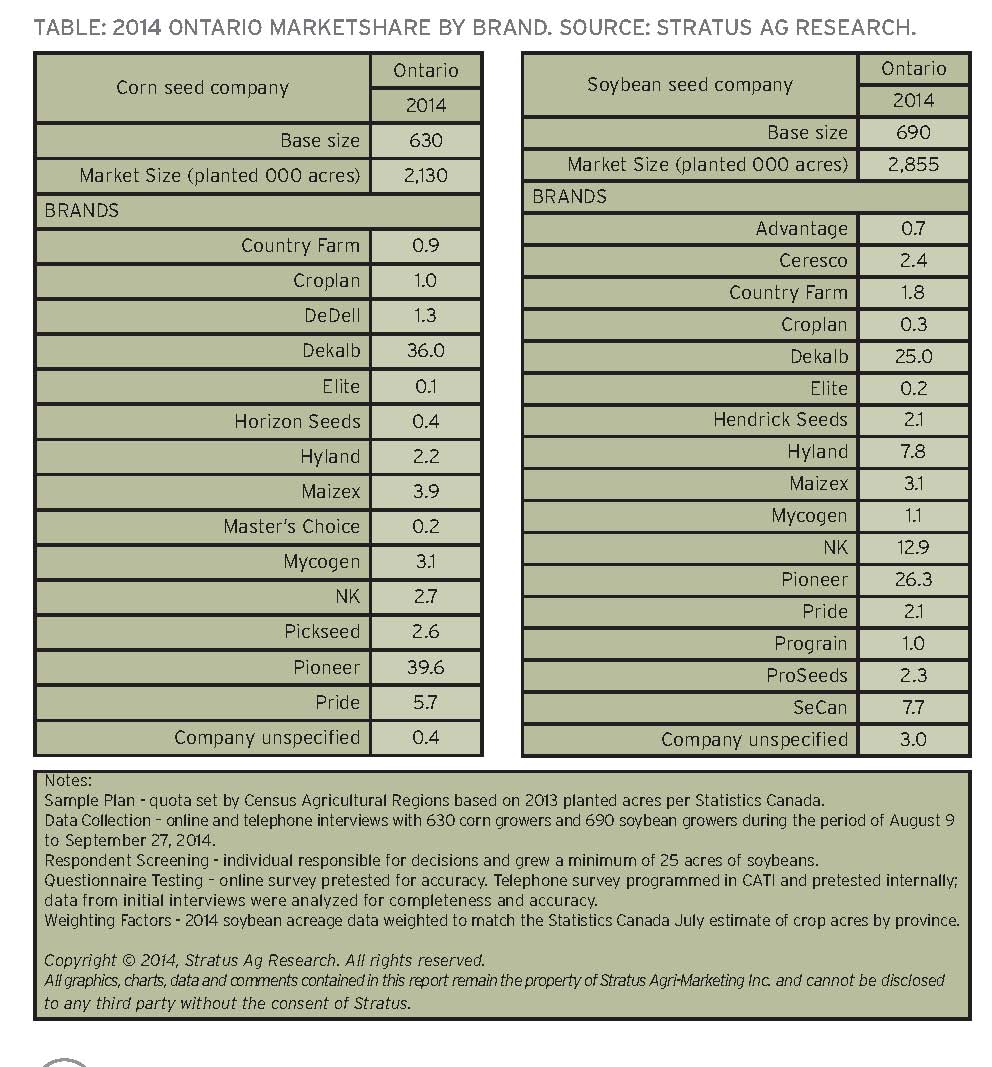

According to Ag Stratus Research, Pioneer and Dekalb dominate the corn seed market. Ag Stratus Research also puts Pioneer soybeans as the top-selling brand in Ontario with 26.3% of the market. The Dekalb brand garners 25% of the market share, and Syngenta’s NK soybean seed just under 13%.

According to Ag Stratus Research, Pioneer and Dekalb dominate the corn seed market. Ag Stratus Research also puts Pioneer soybeans as the top-selling brand in Ontario with 26.3% of the market. The Dekalb brand garners 25% of the market share, and Syngenta’s NK soybean seed just under 13%.

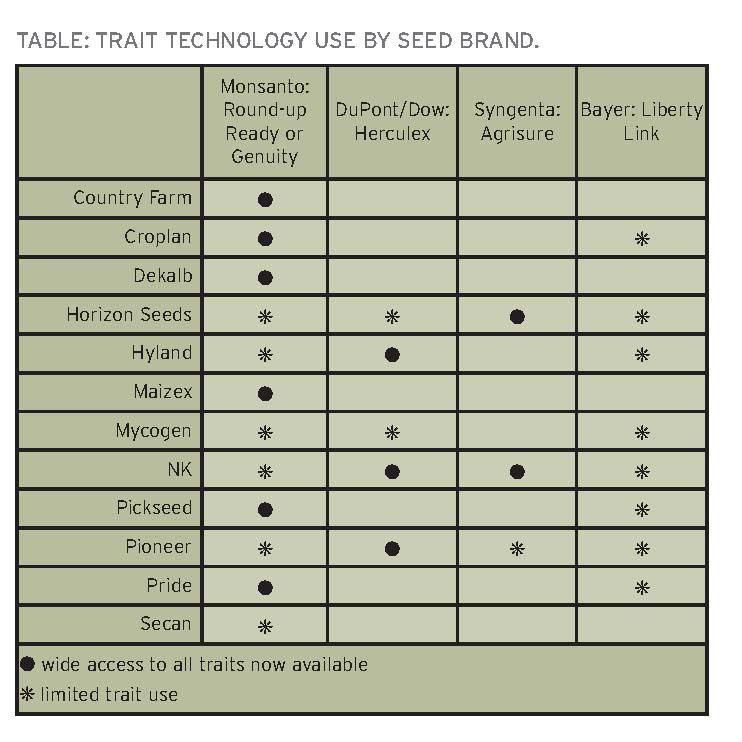

However, brand market share doesn’t tell the whole story of where newly developed traits end up. For example, Monsanto’s Genuity suite of traits appears prominently in the soybean market overall, with other seed companies mixing the technology into their own hybrids. Dan Wright, Monsanto Canada’s national trait launch lead, says there really are few companies in the market place that he doesn’t work with.

“We’ve always broadly licenced our traits, so that gives growers lots of access to buy our biotech traits from different types of companies,” he says.

Sharing technology cuts costs significantly, Wright says. Traits now account for only a small percentage of seed costs in most bags, he notes, depending on the number of traits stacked and the number of generations in those trait families to bear costs.

“Roundup Ready Xtend will be a third generation soybean trait and in 2019, we’re working on our fourth generation introduction,” Wright offers as an example. “It’s great for growers to see this many companies making investments in biotech, breeding, and other things to improve yield,” he adds.

According to Wright, growers consistently ask for yield results but they don’t necessarily expect to see those yield improvements through trait technology.

“This winter, when I spoke about the Monsanto pipeline, I didn’t talk about biotechnology or breeding at all,” he says. “I spoke about our investment in precision planting and in climate modelling.”

That doesn’t mean the company is getting out of trait technology. “A large amount of our investment will continue to be on breeding and biotech,” Wright says, “but the best seed in the world doesn’t stand a chance if it gets laid on top of the ground.”

CORN TRAIT POPULARITY

Nic Bate, one of Syngenta’s lead scientists in trait research, believes that any perception of diminished enthusiasm for corn trait technology is a sign of maturity not obsolescence.

Biotech companies are more reasonable about trait potential and have become smarter about developing the technology. In his opinion, the research culture is much more agnostic than it used to be and researchers can utilize many techniques to develop products a lot faster than in the past.

“Companies would not continue to invest in trait technology if they did not see a future to it,” he assures.

According to Bate, the future of trait development largely follows either the defensive trait path or performance trait path. In the defensive field, which includes insect tolerance and herbicide resistance, researchers largely know what works and must simply evolve that technology to keep up with pests. Bate works on performance traits, such as drought tolerance and yield, which are influenced by the environment and require the additive effect of several genes working together.

“No one’s been able to find that one gene that affects yield across all genetics in a substantial way yet,” laments Bate,” but it’s like the Holy Grail, you’d never know until you found it.”

Bate says every seed company struggles with discussions like whether there’s enough of a business case for drought resistant beans to warrant the cost of that research program. Rachel Faust, a technical marketing manager with DuPont Pioneer, says her company is opting for the efficiency of licensing traits since their core strength is genetics.

“Putting our dollars into base genetics is going to pay bigger value to our customers than putting our dollars into traits,” she says. “There are some great traits being developed by competing companies and our preferred direction is to incorporate those into our genetics versus trying to recreate traits that are already working well.”

Faust says this doesn’t mean that DuPont is abandoning trait technology entirely. Currently they are working to release a new molecular stack of Herculex traits, which will allow breeders to work with a broader cross section of genetic material.

“When you put traits into hybrids, sometimes a little bit of extra genetic material comes in,” she explains. “This will be more compatible with a broader range of genetics within our library of germplasm.”

Even with the added cost of trait-stacks, Faust says genetics still account for the majority of seed development investments. And since transgenic traits take so long to bring to market, they’re now breeding for native characteristics that will serve farmers’ needs in the meantime.

SOYBEAN TRAIT POTENTIAL

David Kikker, soybean seeds and traits manager for Bayer CropScience, says the trait race isn’t over in soybeans. “In soybeans, different herbicide trait options are where the work is being done and that’s based on the market,” he says.

Bayer is in the unique position of not having a seed line of their own. “But, with not being in the seed business, we can focus on the trait business and work with our seed partners,” he says. “With commodity price increases, we’re seeing more attention put on soybeans.”

At this point, you could say the race to bring alternatives for weed management to market is very much alive. Kikker says Bayer is getting very close to releasing their Balance GT trait, which would allow herbicides such as Converge Flexx to be used for soybean weed management.

Regulatory approval has also been holding up Dow’s Enlist seed trait, which would enable glyphosate and 2-4D choline tolerance, and Monsanto’s Roundup Ready Xtend seed trait, offering glyphosate and dicamba tolerance.

Kikker says that although soybean varieties currently on the market don’t feature traits from multiple companies the way stacked corn hybrids do, that isn’t written in stone for the future.

The wild card in projecting where trait development could go beyond herbicide resistance is the growth of soybean acres in Western Canada. Kikker says that if development of soybeans with shorter maturities for that region grows, interest in traits such as drought tolerance just might start a whole new race all over again. •