U.S. exports to Cuba

U.S. EXPORTS TO CUBA

CUBA’S 12 MILLION people represent an untapped potential market for corn, soybean, and wheat exports, but the ongoing U.S. embargo against Cuba makes it unlikely that U.S. farmers will make major inroads into that market in the short term.

Officials at the U.S. Grains Council (USGC), which has been working for almost two decades to develop Cuban demand for coarse grains, say the island has the potential to become the 11th largest export market for U.S. corn. It currently is a million ton corn market,

Cuba is the largest market in the Caribbean for wheat, but has not bought U.S. wheat in recent years because of the U.S. embargo, according to U.S. Wheat Associates, a non-profit market development organization.

At the American Soybean Association (ASA), vice president John Heisdorffer faulted a Trump Administration executive order that rolls back provisions to open Cuba to American investment, saying it puts in jeopardy the ASA’s progress in developing soybean exports.

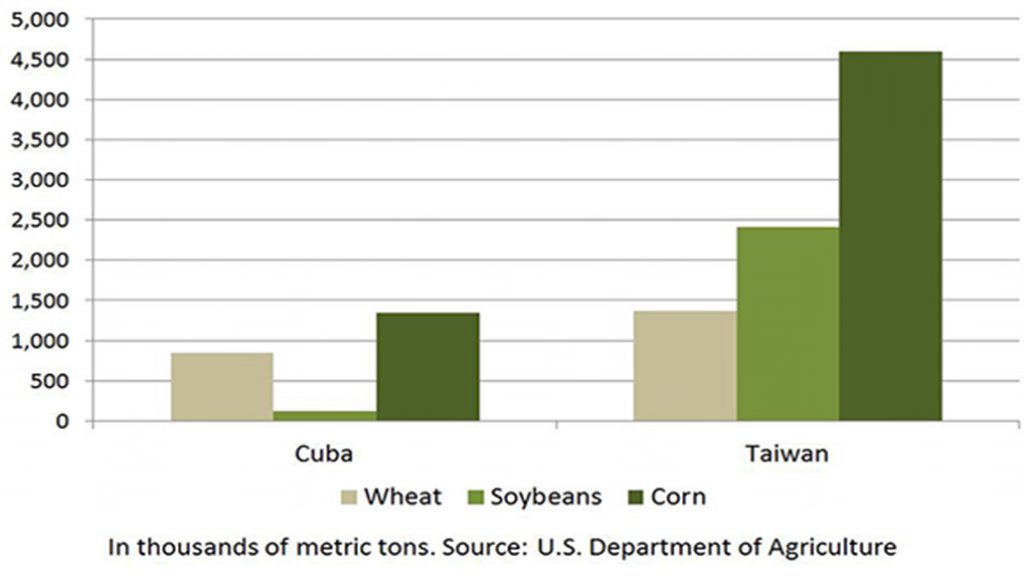

The three organizations did not provide projections for Cuba’s market potential, but comparisons with another island nation are instructive.

COMPARATIVE MARKET

Taiwan’s population is about double the population of Cuba, but decades of technical improvements and economic development have improved living standards (including diets) in Taiwan. That has made Taiwan an important importer of U.S. grains and oilseeds. As of last year, Taiwan’s wheat consumption was roughly double Cuba’s, its corn consumption was three and a half times that of Cuba, and its soybean consumption was 20 times Cuba’s (see graph to left).

A major barrier to expanded U.S. sales is the embargo that prevents sellers from offering credit for Cuban purchases.

Steve Mercer, vice president for communications at U.S. Wheat, says there is little reason for his organization to maintain promotional programs while the embargo is in place. “Buyers and the government look at the embargo and say, ‘look, we have other options for wheat, so we’ll buy somewhere else.’” Elsewhere in the Caribbean, the U.S. enjoys an 80% market share. If policy changes made U.S. wheat exports competitive, Cuba could become a steady market for 24 million bushels of U.S. wheat, primarily hard red winter wheat from the central and Great Plains states, according to Mercer.

That number could go higher if Cuba’s economy grows — for example, tourism could increase demand.

Mark Albertson, ASA director of market development, also argues that the inability to offer credit makes American soybeans less competitive than soybeans from Brazil and Argentina, but cites a second disadvantage — the embargo bans backhaul cargos, so that containers used to transport U.S. commodities to Cuba must return empty, which boosts transportation costs.

Looking beyond current policy restrictions, Marri Carrow Tejada, regional director for the USGC, sees Cuba’s long-term growth as a market depending on changes in Cuba itself that would encourage entrepreneurship and economic growth.

She points to another Communist country as an example. “Vietnam is growing, growing, growing. If Cuba’s government policies encourage that, the Cuban market has no place to go but up,” Carrow says. •