Market side: Futures trading basics

LESSON 25: TECHNICAL ANALYSIS

This monthly educational series features the basic workings of the futures and options markets and how they can be utilized to help farmers with risk management.

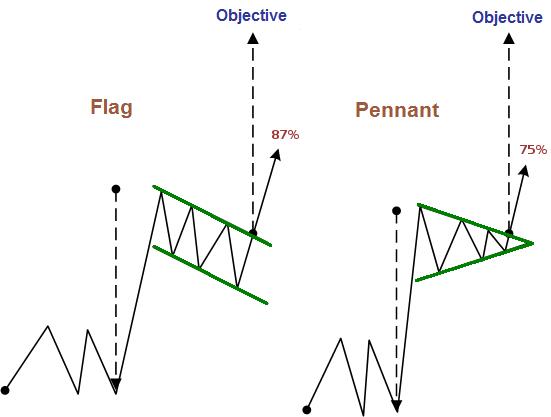

FLAGS AND PENNANTS

Flags and pennants are among the most reliable of continuation patterns and only rarely produce a trend reversal. Both appear in continuation patterns and are more short term than long term. Both are very similar in their nature but differ in their shape. They represent brief pauses in the dynamic market move that is underway.

To qualify as a continuation pattern, there must be evidence of a prior trend. The first part of such a pattern requires a rather quick move up or down with significant volume in the direction of the established trend. Our flags or pennants usually represent the first leg of such a move where it will pause before continuing the move in the same direction.

A flag is a small parallelogram or rectangle pattern that slopes away from the current move. It looks like a rectangle which is formed by two parallel trend-lines, one of them acting as support and the other resistance. If the existing move is up, the flag would slope down. If the move is down, then the flag would slope upwards.

A pennant, on the other hand, is constructed by two converging trend-lines and looks like a small horizontal symmetrical triangle that begins wide and converges as the pattern matures.

Both patterns are short term; in downtrend they tend to take less time to develop and may last a maximum of two weeks. The slope on a pennant is usually neutral.

The flag or pennant marks a resting point in an extended move before it resumes towards its target.

The distance from the first resistance or support break to the high or low of the flag/pennant is called the flagpole. The sharp advance (or decline) that forms the flagpole should break a trend line or resistance/support level. A line extending up from this break to the high of the flag/ pennant forms the flagpole.

HOW TO TRADE FLAGS/PENNANTS

Like the triangle formations, flags and pennants are traded similarly. A break above the flag or pennant constraints should project to the length of the flagpole. Volume should be heavy during the advance lighter as the flag/pennant is formed. Likewise, volume should resume on the break from the formation to complete the extension of the flagpole towards the target.

Notice in both formations how the price continues in the original direction, once the flag or pennant breaks through the pattern.

Marty Hibbs is a 25 year veteran futures trader, analyst, and portfolio manager. Hibbs was a regular guest analyst on BNN for four years. He is currently a grain merchandiser with Grain Farmers of Ontario.

DISCLAIMER: This information has been compiled from sources believed to be reliable, but no representation or warranty, express or implied, is made by the author, by Grain Farmers of Ontario, or by any other person as to its accuracy, completeness or correctness and Grain Farmers of Ontario accepts no liability whatsoever for any loss arising from any use of same.

Lesson Definitions:

Flagpole: The initial move either up or down (depending on the trend) from a breakout. Once the initial move is completed, the price action and volume settle down to form the flag/pennant before resuming its move higher as an extension of the flagpole. Both sides of the move are referred to as flagpoles. •