Ontario grains by the numbers

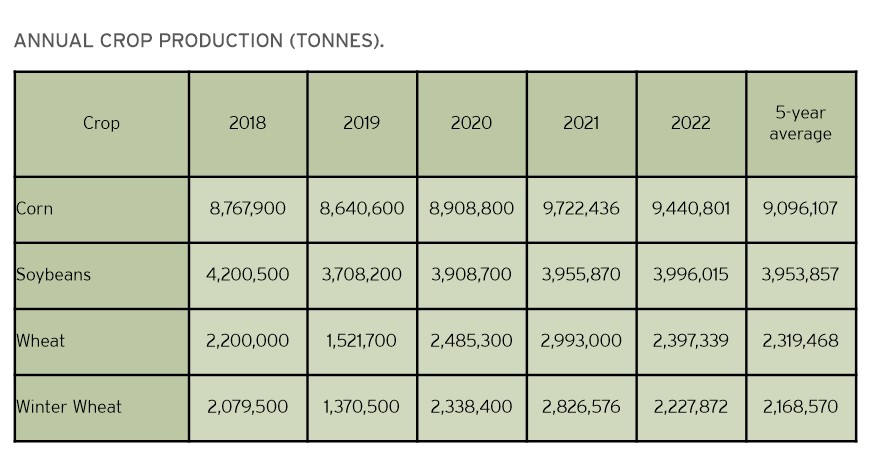

FIVE-YEAR PRODUCTION AND EXPORT TRENDS

ONCE ONTARIO’S GRAIN and oilseed crops leave the farm, where do they go? Grain Farmers of Ontario’s Market Development team has tallied the numbers.

2022

Ontario has continued to lead corn, soybean, and winter wheat production within Canada. The 2022 crop year saw Ontario produce over 80 per cent of Canada’s winter wheat production and nearly two-thirds of Canada’s corn and soybean production, making Ontario the leading region for production.

- In 2022, Ontario produced 9,440,801 tonnes of corn, which accounted for 64.9 per cent of Canada’s total production. On average, Ontario produces 65 per cent of Canada’s total corn crop.

- In 2022, Ontario produced 3,996,015 tonnes of soybeans, which accounted for 61.1 per cent of Canada’s total production. On average, Ontario produces 60.5 per cent of Canada’s total soybean crop.

- In 2022, Ontario produced 2,227,872 tonnes of winter wheat, which accounted for 82.5 per cent of Canada’s total production. On average, Ontario produces 83.9 per cent of Canada’s winter wheat and 7.4 per cent of Canada’s total wheat.

FIVE-YEAR TAKEAWAYS

Over the past five years, wheat has been Canada’s largest crop by volume; corn has been a third; and soybeans have been fifth.

Due to growing conditions, weather, and demand trends, Ontario’s crop production has fluctuated over the past five years. 2019 saw lower production across all three main crops compared to the five-year average, especially for wheat, due to issues with winter kill. 2021 had noticeably higher production for wheat and corn; both crops produced at least 600,000 tonnes more than the five-year average. Production of soybeans peaked in 2018 at 4,200,500 tonnes and has not again reached that level.

- Ontario’s production in 2022 was higher than the province’s five-year average across the three major crops.

- Ontario wheat production in 2022 was 3.4 per cent higher than the five-year average of 2,319,468 tonnes.

- Ontario corn production in 2022 was 3.8 per cent higher than the five-year average of 9,096,107 tonnes.

- Ontario soybean production in 2022 was 1.1 per cent higher than the five-year average of 3,953,857 tonnes.

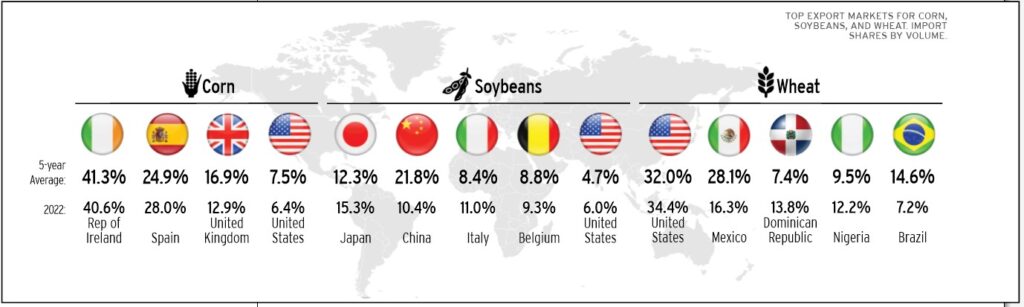

TOP EXPORT MARKETS

Corn – Exports of corn from Ontario have fluctuated over the past five years, with a general increase in value from 2018 to 2022 and the majority of exports destined for markets in Europe. Ireland and Spain have continued to lead the market for Ontario corn, with the United Kingdom and the United States gaining significance as well. In 2022, Ireland was the leading importer of Ontario corn, with a majority import share of 40.51 per cent, equating to 384,811 tonnes and $148,307,737 CAD.

- The volume of Ontario corn exports was 949,901 tonnes in 2022, which corresponds to a value of $374,015,221 CAD. This was slightly lower than the 5-year average of 955,791 tonnes.

- Ireland and the United Kingdom’s import shares have declined slightly, allowing markets like Spain to capture more of Ontario’s corn in 2022.

- Ireland primarily uses Ontario corn for animal feed, as they are a major livestock producer and are limited in corn production due to their climate and landscape.

Soybeans – Exports of soybeans from Ontario have managed to remain relatively stable in value over the past five years, serving markets primarily in Asia and Europe. Japan has been the predominant source of value from soybean exports and had a 15.31 per cent import share in 2022, which equates to a volume of 222,493 tonnes and a value of $213,642,821 CAD. Other top countries include China, Italy, Belgium, and the United States. Since 2018, the Ontario soybean export market has become more saturated and diversified, with many players holding significant shares.

- The volume of Ontario soybean exports was 1,453,491 tonnes in 2022, which corresponds to a value of $1,253,935,453 CAD. This was slightly lower than the five-year average of 1,702,373 tonnes.

- Japan and Italy’s import shares have increased from 2018 to 2022, while China and Belgium’s shares have decreased.

- Japan uses primarily Ontario food-grade soybeans for products such as tofu, natto, miso and soy sauce. Most of Japan’s cultivated land is used for rice and wheat, which increases demand for quality soybeans.

Wheat – It can be challenging to isolate Ontario wheat export statistics, as Western Canadian wheat regularly flows through the province via the Port of Thunder Bay and the Great Lakes before export through the St. Lawrence Seaway. This leads to something of a Rotterdam effect, skewing Ontario’s export statistics. The Canadian Grain Commission’s (CGC) export statistics, which capture vessel loadings, provide the most reliable indication of trade volumes, with the exception of trade by rail and truck. For this article, we have included CGC vessel statistics only, and it should be noted that U.S. export volumes, in reality, are much higher as these values do not include trucked or railed wheat.

- The volume of Ontario wheat exports was 342,200 tonnes in 2022. This is slightly lower than the five-year average of 420,220 tonnes.

- The United States has had a consistently high import share in Ontario wheat over the past five years and had a 34.4 per cent import share in 2022, which corresponds to 117,700 tonnes.

- Mexico remains a top destination for Ontario wheat and has become a prominent miller of wheat, importing 55,800 tonnes in 2022.

Barley and Oats – Ontario grows both barley and oats, a majority of which is used domestically for animal feed and human consumption. The United States remains a key market for Ontario barley and oat exports.

- Ontario produced 104,588 tonnes of barley in 2022, which accounted for 1 per cent of Canada’s production.

- Ontario produced 11,869 tonnes of oats in 2022, which accounted for 2.1 per cent of Canada’s production.

- Almost all oats exported from Ontario are destined for the United States.

Connor McCulloch is the market development assistant at Grain Farmers of Ontario. •