Sustainable finance on the farm

INVESTMENT DECISIONS USING ESG PRINCIPLES

INDUSTRY CAN HAVE positive and negative impacts on the environment and society. Accounting for these impacts and companies’ actions to demonstrate progress is of increasing interest among investors and financial institutions. For many involved in Canadian agriculture production, sustainable finance has been a background driver of some programs supporting sustainable practices but has yet to appear in the limelight. However, this may change with emerging standards and guidance for companies reporting on their value chain’s sustainability impacts and an increasing number of sustainable finance products, services, and programs available to Canadian farmers and agri-food businesses.

WHAT IS SUSTAINABLE FINANCE?

Sustainable finance refers to financial activities that consider environmental, social, and governance (ESG) indicators to promote sustainable economic growth and the long-term stability of the financial system. For example, when considering sustainability in financial and investment decisions, economic indicators such as monetary value and projected growth are, of course, essential and primary factors, but an investment firm, company, or even an individual may also base their decisions on the climate impacts of a company’s operation or how a company treats their workforce.

According to PwC, RBC, and others, key indicators in sustainability reporting include but are not limited to:

Environment: carbon emissions, water consumption, land use, energy consumption, waste disposal.

Social: health and safety, gender and diversity, community, data privacy and security.

Governance: board structure, executive compensation, shareholder rights, partnerships, transparency and reporting.

Companies, financial institutions, and other organizations use sustainability reporting standards, including those developed by the Global Reporting Initiative. Sustainability reporting standards and frameworks allow for consistency and comparability among companies’ sustainability rankings and ratings, which are important tools to inform sustainable investment and lending decisions. According to a 2022 report by KPMG, 91 per cent of Canada’s top 200 revenue-generating companies report on their ESG performance.

WHY DOES SUSTAINABLE FINANCE MATTER TO THE AGRICULTURE SECTOR?

Sustainable finance includes a diverse range of important indicators; however, there is currently a strong focus on measuring, reporting, and verifying a company’s performance in reducing greenhouse gas emissions from their operations, energy use, and value chains.

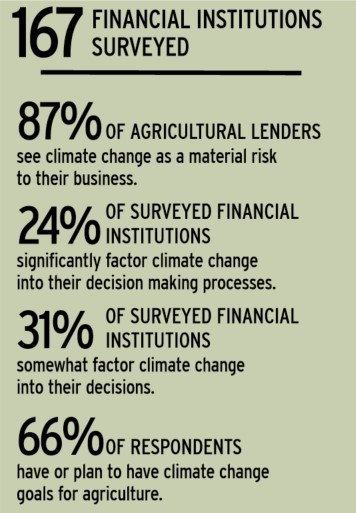

To better understand how climate is factored into investment and lending decisions in agriculture, Deloitte and the Environmental Defense Fund conducted a survey.

These results (chart to the right) suggest that financial institutions focused on agriculture are concerned about climate change’s impacts, yet only some are currently factoring climate change risks and opportunities into their decision-making.

A key barrier to factoring climate change indicators into investment and lending decisions is a lack of agricultural practice, production, and environmental data. This data is needed to inform measurements and estimates of greenhouse gas emissions from agricultural production. Recently established and pending regulations that provide standards for companies to report on greenhouse gas emissions may be a key driver for addressing this barrier. These regulations include the U.S. Securities and Exchange Commission’s proposed rules to enhance and standardize climate-related disclosures for investors. The rise in standardization of corporate sustainability reporting is in response to investor demand for greater transparency and consistency. For example, there are approximately 5,300 investors who manage more than USD $121.3 trillion that are signatories to the United Nation’s Principles for Responsible Investment, which outline actions for incorporating ESG issues into investments.

The increasing interest in sustainable finance can interact with the agriculture sector in several ways. One potential implication is the expanding interest in data from agri-food value chains. As organizations work to understand and improve ESG performance in their value chains, they may seek out data from suppliers. For example, a food company may want to understand better the carbon intensity of the production of raw ingredients they use in their products. This data could contribute to establishing a baseline to track progress and help the company identify opportunities to support practice adoption, such as nutrient stewardship to reduce the carbon intensity of production over time. According to a 2022 report by Ernst & Young, digital tools, central data platforms, and value chain collaboration are promising approaches to meet sustainability data demands.

Another way sustainable finance can impact the agriculture sector is by increasing the availability and options of financial products and services that support or reward farmers and agri-food businesses in their efforts to improve sustainability in agriculture continuously. Many of these financial mechanisms provide incentives such as discounts on premium rates to farms and other agricultural businesses on their investments and loans for maintaining or adopting sustainable practices and technologies.

EXAMPLES OF SUSTAINABLE FINANCE

Sustainable financing programs, products, and services in agriculture may look different depending on many factors, including the sustainability goals of the organization, its partners, stakeholders, and clients, as well as their level of interest and expertise in sustainable financing.

A financial institution’s engagement in sustainable finance in agriculture can stem from its broader investments in sustainability that the agriculture-specific initiatives fall under. For example, in 2021, BMO committed to mobilizing $300 billion by 2025 in sustainable finance. In Spring 2023, BMO announced Greener Futures Financing, which includes a sustainable finance program for new and current agriculture business banking clients. These clients are potentially eligible for a discount of up to one per cent on new loans for investments in reducing emissions or implementing climate resilience measures, such as improving on-farm energy efficiency. Sustainable finance products and programs can also be driven through partnerships, as observed through Farm Credit Canada’s Sustainability Incentive Program, which provides payments to farmers that meet their partners’ sustainability requirements. Finally, Rabobank, a global financial institution with expertise in agriculture and sustainable finance products, offers green and sustainability-linked loans, which they note are growing in demand.

Sustainable finance is fast evolving, and its impact on the agriculture sector is becoming more tangible. At this stage, it is difficult to determine all the implications for farmers, as many standards and regulations are pending, and companies and value chains are developing approaches to improve their ability to track ESG performance.

Lisa Ashton is the sustainability and environment lead at Grain Farmers of Ontario. •