U.S. ethanol exports

PRODUCTION INCREASES

AS THE U.S. domestic market faces limits on its capacity to absorb more ethanol, the export market is gaining importance, and an Environmental Protection Agency proposal to scale back blending requirements could create more pressure to expand export sales.

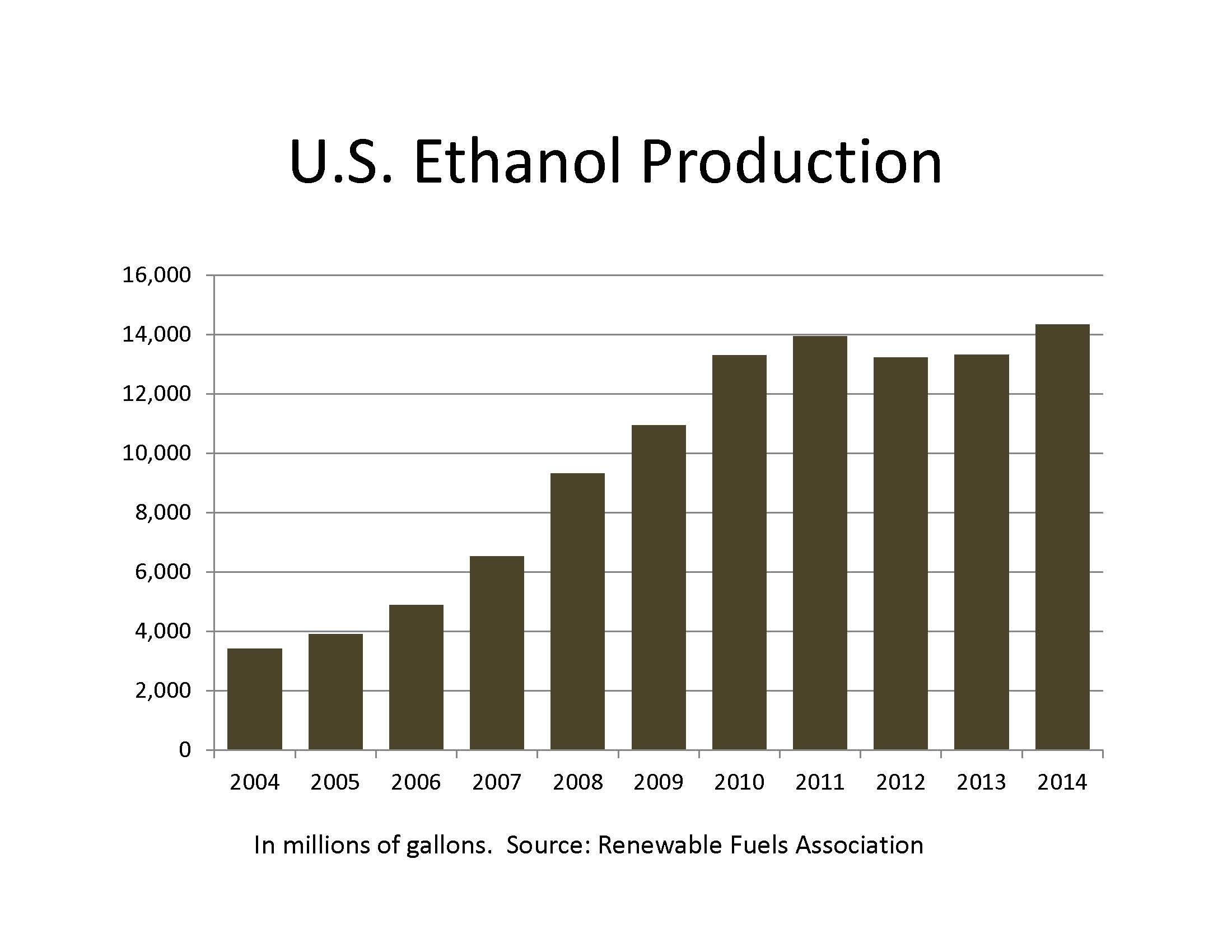

U.S. ethanol production skyrocketed with the 2005 passage of the Renewable Fuels Standard, which mandates a certain amount of ethanol use in fuels. However, after 2010, production stagnated as domestic markets neared limits on how much ethanol they could handle.

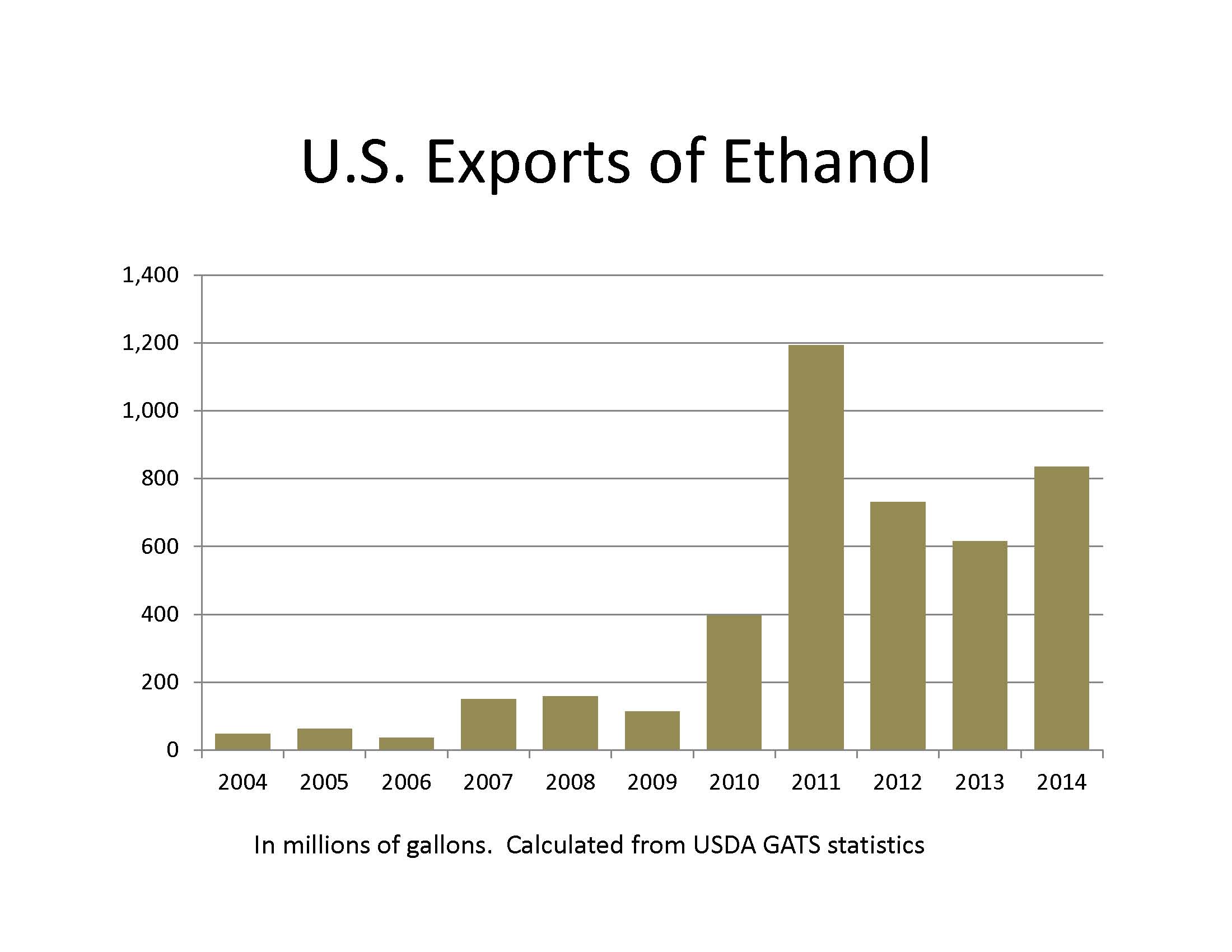

Meanwhile, the volume of exports began to climb, hitting a peak of 1.1 million gallons (8.6% of usage) in 2011 (see graph). After a pull-back in 2012 and 2013, exports again began climbing. In 2014, the U.S. surpassed Brazil as the world’s largest ethanol exporter for the second time. Based on January-to-June shipment data, the U.S. is on trend to export more ethanol this year than in 2014.

Canada has been the dominant destination for U.S. ethanol, taking 40% last year, but that could change. In 2014, the strongest growth for U.S. exports was in the United Arab Emirates, the Philippines, and India, and a new U.S. market development initiative is targeting additional countries.

The initiative, a joint effort by the U.S. Grains Council, the Renewable Fuels Association, and Growth Energy, is in the process of evaluating markets for development. The potential list ranges from the Philippines, China, and India to Mexico, Colombia, Peru, and Indonesia. All have ethanol blend mandates of one kind or another, but the approach to market development is likely to vary from country to country — for example, in the Philippines it could be part of the effort to meet existing blend requirements while in China it could be part of air pollution control initiatives. Resources to support market expansion efforts will come from the USDA’s Foreign Agricultural Service’s Foreign Market Development and Market Access Program funds.

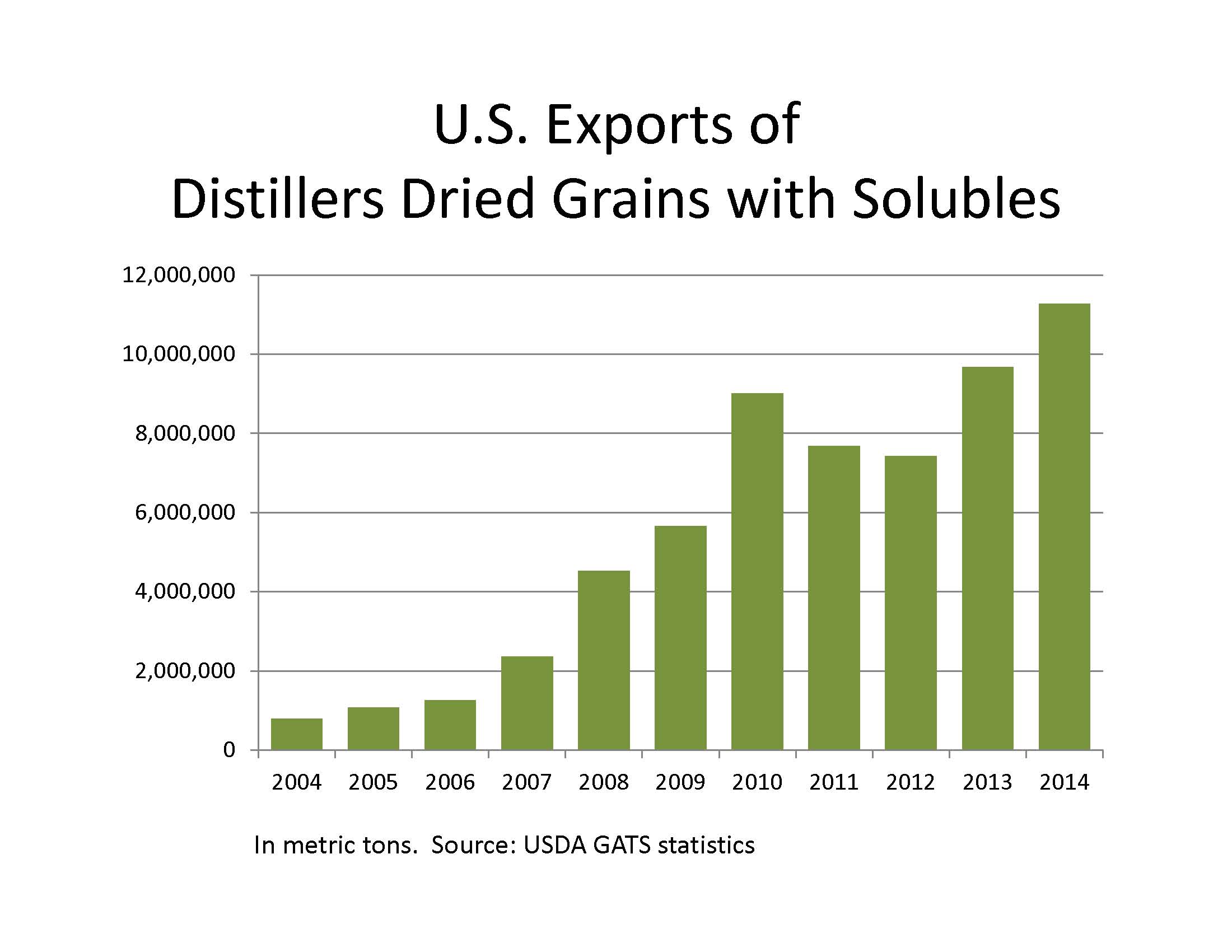

Export sales of distillers dried grains with solubles (DDGS) are already a critical factor in U.S. ethanol plant profitability, having grown from less than 800,000 metric tons in 2004 to more 11 million metric tons (mmt) in 2014 (see graph), and January-to-June sales suggest 2015 exports will again pass the 11 mmt mark.

Roughly a third of each bushel milled for ethanol ends up as livestock feed. DDGS is a co-product of dry milling ethanol production. Ethanol produced by wet milling (refining) results in corn gluten feed and corn gluten meal co-products. •