Accelerated Investment Incentive

NEW TAX DEDUCTION RULES

IF YOU HAVE a tax advisor, it’s likely they talked to you last fall about the Accelerated Investment Incentive that the Federal government announced in their 2018 Fall Economic Statement. This incentive will accelerate your capital cost allowance (CCA), which is the tax deduction that represents the depreciation of a capital asset. This new Accelerated Investment Incentive applies to equipment purchased after November 20, 2018.

Simply put, it means that you can write off your newly purchased equipment at a faster rate than before.

HOW DOES IT WORK?

There are two features to the Accelerated Investment Incentive:

1. Normally in the year that equipment is acquired, only half of its value is available for capital cost allowance (CCA). Under the new rules, this “half year rule” will not apply.

2. Secondly, the value of the acquisition for the purpose of the CCA calculation will be increased by 50%, which will give you a larger deduction amount.

The combination of these two changes means that the CCA available in the first year will be three times larger under the new rules.

A COUPLE OF THINGS TO REMEMBER

The first is that the CCA decreases your taxable income just like any other deduction. This means you pay less tax. However, if your taxable income is already low due to other circumstances, the larger CCA may not help you much in the current year. Fortunately, CCA can be carried forward to subsequent years and applied when your taxable income is hopefully higher.

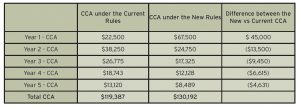

Secondly, the new CCA calculation front loads the deduction in year one (as Table 1 shows). In subsequent years, the amount is smaller than the normal calculation. If your goal is to even out your tax bill, then a discussion with your tax advisor on how much of the CCA you want to use each year would be important.

SOME TECHNICAL BITS

The rules above will not apply to Class 53 (manufacturing and processing machinery and equipment) and Classes 43.1 and 43.2 (clean energy equipment) which will be eligible for a full deduction (100%) in the year of purchase. Some farmers who do some on-farm processing may have equipment that falls into this class.

Producers should contact their tax advisors and discuss these changes to see how they can be used to their best advantage.

Rob Gamble is the chief economist for Grain Farmers of Ontario. •