2021 Census of Agriculture

GRAINs AND OILSEEDS GRAB A SHARE OF THE SPOTLIGHT

ONTARIO’S GRAIN AND oilseed sector has grabbed an unprecedented share of the spotlight in the new Census of Agriculture. The census, conducted every five years, shows that Ontario grain and oilseed farms account for a growing share of the total Canadian farmland dedicated to grain and oilseed production.

That share was nearly 28 per cent, compared to 26.5 per cent in 2016. Only Saskatchewan ranked higher, at 31.4 per cent. Similarly, Ontario farms classified as grain and oilseed increased by 4.6 per cent, compared to the national estimate of -0.4 per cent. Operating

revenues (sales from commodities) in grains and oilseeds realized a whopping 30 per cent increase from 2015 to 2020, rising to $4.8 billion.

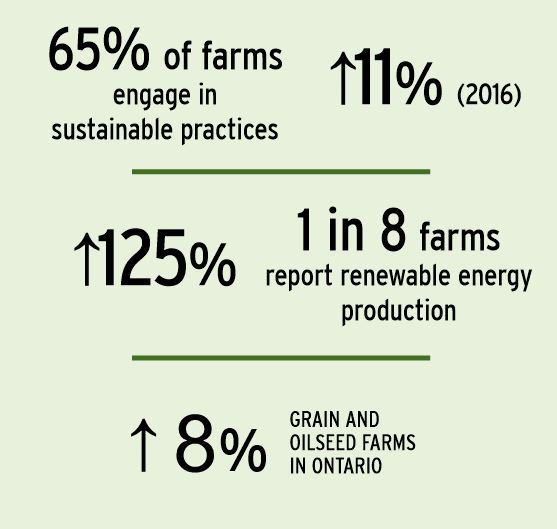

And while the total number of farms in Ontario fell by 2.5 per cent (as they did nationally, by 1.8 per cent), the number of operations identifying grains and oilseeds as their main income source rose by almost eight per cent. Canada overall saw a 0.7 per cent increase in total farm area for farms classified as grain and oilseed. Ontario realized a 2.5 per cent increase.

“Grains and oilseeds are bucking any downward trend,” says Statistics Canada analyst Matthew Shumsky, who specializes in agriculture. “You’re seeing grain and oilseed farms in Ontario taking a larger share.”

Profitability is one reason for the interest in grain and oilseed production. Statistics Canada noted that the expenses-to-revenues ratio across farm types showed that farms classified as oilseed and grain farming were the most profitable in 2020, with an expenses-to-revenues ratio of 0.76 (sheep and goat farms had the highest ratio, at 0.97).

BIGGER FARMS TREND UPWARD

The census showed that bigger farms were trending upwards. In Ontario, the number of grain and oilseed-dominant farms with $2 million or more in sales (based on current dollars) skyrocketed by 90 per cent. Nationally, those farms increased in number by almost 65 per cent.

Farms in the top sales classes in Canada also account for the largest share of total farm operating revenues and a larger share of total farm employees. For example, in 2020, farms reporting at least $2 million in sales accounted for 51.5 per cent of total farm operating revenues, 10 per cent more than in 2015.

Shumsky says the large-farm growth is noteworthy. “Farms are becoming larger business entities as agriculture becomes more sophisticated,” he says. “The sector is adapting and modernizing, with higher rates of technology adoption, renewable energy production, use of direct marketing solutions, and sustainable farming practices… in view of the issues and challenges all farm operators have faced, such as the pandemic, trade disputes and rising land prices, the grain and oilseed sector’s performance in Ontario speaks to its resiliency.”

Canada’s smallest farms are also finding a niche and enjoying a growth spurt. Across Canada, farms under 10 acres grew by a little more than 400 farms to 13,607. Farms in the next smallest category, 10 – 70 acres, held their own at about 32,000 farms. And farms 70 – 130 acres saw the biggest increase, with nearly 1,000 more units added.

That may reflect consumers’ interest in niche products, greenhouse produce, on-farm and direct sales, farmers’ markets purchases, or local food sales by select retailers.

AN AGING PROFESSION

Statistics Canada pointed to numerous other findings when the census results were released in May. For example, farm operators are continuing to age. The average age of farmers increased by one year to 56, and the proportion of farm operators aged 55 and older grew by six per cent, rising to almost 61 percent. Compare that growth to Canada’s share of young operators, which fell to 8.6 per cent from 9.1 per cent in 2016.

The number of farm operators reporting off-farm work has grown too, to involve 125,280 farm operators, up 3.8 per cent from the previous census. That’s 47.7 per cent of farm operators in Canada. Of these farm operators, the proportion who worked off-farm on a full-time basis declined slightly to 66 per cent…but the number of those working part-time off the farm increased two per cent to 34 per cent.

TOP CROPS

As for crops, canola remained the top crop acreage in Canada among all types of hay and field crops in the 2021 census — despite a ban from China that restricted total canola exports from Canada in 2018 and 2019. In 2021, Canadian farms reported 22.3 million acres of canola, an 8.1 per cent increase in canola acreage from the previous census. Farms also reported a 2.1 per cent increase in spring wheat acreage, the second-largest crop in Canada in 2021, with 16 million acres. It was followed by barley, alfalfa, and durum wheat.

Nearly one in eight Canadian farms in Canada — close to 12 per cent of the total — reported some form of renewable energy production in 2021. That was more than double the previous census.

Statistics Canada says technology has a growing role in Canadian farming. Automated guidance steering systems use is up 28 per cent from the previous census, as is geographic information system mapping (up nearly 59 per cent). And more producers were engaged in environmental sustainability activities, citing in-field winter grazing or feeding, rotational grazing, plowing down green crops, planting winter cover crops, and having shelterbelts or windbreaks. In 2020, almost 65 per cent of farms reported such practices, an 11 per cent jump.

Producers also reported shifting their focus to more drought-tolerant crops, such as barley, which saw a 24.3 per cent increase in acreage. That was the biggest percentage increase among Canada’s top 10 contributors of hay and field crops.

The number of farms that produced organic products increased significantly from the last census, up nearly 32 per cent, involving 5,658 farms. These farms made up three per cent of total farms in 2021, compared with 2.2 per cent five years ago. “Sustainable practices are becoming a hallmark of Canadian agriculture,” says the department. •